X`

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant |

|

Filed by a Party other than the Registrant |

Check the appropriate box:

Preliminary Proxy Statement

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

Definitive Proxy Statement

Definitive Additional Materials

Soliciting Material Pursuant to §240.14a-12

LM FUNDING AMERICA, INC.

(Name of Registrant as Specified in Its Charter)

____________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

No fee required.

Fee paid previously with preliminary materials.

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

.

DOCPROPERTY DOCXDOCID DMS=NetDocuments Format=<<ID>>.<<VER>> \* MERGEFORMAT 4888-9318-2688.3

NOTICE OF ANNUAL MEETING

AND PROXY STATEMENT

[], 2024

You are cordially invited to attend our Annual Meeting of Stockholders, which will be held at 1200 West Platt Street, Suite 100 Tampa, Florida 33606, on [], [], 2024, at [], local time. Stockholders will be admitted beginning at [].

In accordance with the Securities and Exchange Commission rules allowing companies to furnish proxy materials to their stockholders over the Internet, we have sent stockholders of record at the close of business on September 12, 2024, a Notice of Internet Availability of Proxy Materials. The notice contains instructions on how to access our Proxy Statement and Annual Report and vote online. If you would like to receive a printed copy of our proxy materials from us instead of downloading a printable version from the Internet, please follow the instructions for requesting such materials included in the notice, as well as in the attached Proxy Statement.

The attached notice of Annual Meeting of Stockholders and proxy statement cover the formal business of the Annual Meeting and contain a discussion of the matters to be voted upon at the Annual Meeting.

Your vote is very important. Please act as soon as possible to vote your shares. It is important that your shares be represented at the meeting whether or not you plan to attend the Annual Meeting. Please vote electronically over the Internet, by telephone or, if you receive a paper copy of the proxy card by mail, by returning your signed proxy card in the envelope provided. If you later decide to attend the Annual Meeting and vote in person, you may revoke your proxy at that time.

On behalf of the Board of Directors and management, I would like to thank you for choosing to invest in LM Funding America, Inc. and look forward to your participation at our Annual Meeting.

Bruce M. Rodgers, Esq.

|

|

Chairman of the Board Chief Executive Officer |

LM Funding America, Inc. •1200 West Platt Street, Suite 100, Tampa, FL 33606 • T (813) 222-8996 • F (813) 221-7909 • lmfunding.com

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO THE STOCKHOLDERS OF LM FUNDING AMERICA, INC.:

TIME: |

[], local time, on [],[], 2024. Stockholders will be admitted beginning at [] |

|

|

|

|

PLACE: |

LM Funding America, Inc. 1200 West Platt Street, Suite 100 Tampa, Florida 33606 |

|

ITEMS OF BUSINESS: |

1. |

To elect two Class II directors to hold office for a three-year term ending at the third annual meeting of stockholders following their election; |

|

|

|

|

2. |

To ratify the appointment of MaloneBailey, LLP as the company’s independent auditor to audit the company’s 2024 financial statements;

|

|

3. |

To approve an amendment and restatement of the LM Funding America, Inc. 2021 Omnibus Incentive Plan;

|

|

4. |

To approve, in accordance with Nasdaq Listing Rule 5635(d), the issuance of more than 19.99% of our outstanding common stock issuable upon the exercise of common warrants;

|

|

5. |

To conduct an advisory vote on the compensation of our named executive officers as disclosed in this proxy statement; and |

|

6. |

To transact such other business that may properly come before the meeting or any adjournments or postponements thereof. |

|

|

|

RECORD DATE |

Stockholders of record on September 12, 2024, are entitled to notice of the Annual Meeting and are entitled to vote at the Annual Meeting in person or by proxy. |

|

|

|

|

ANNUAL REPORT |

Our 2023 Annual Report to Stockholders, as amended, which is not a part of this proxy statement, is being provided herewith. |

|

|

|

|

PROXY VOTING

|

It is important that your shares be represented at the Annual Meeting and voted in accordance with your instructions. Please promptly vote your shares by following the instructions for voting on the Notice of Internet Availability of Proxy Materials or, if you received a paper or electronic copy of our proxy materials, by completing, signing, dating and returning your proxy card or by Internet or telephone voting as described on your proxy card. |

|

By Order of the Board of Directors,

Bruce M. Rodgers

Chairman of the Board

Chief Executive Officer

LM Funding America, Inc. •1200 West Platt Street, Suite 100, Tampa, FL 33606 • T (813) 222-8996 • F (813) 221-7909 • lmfunding.com

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON [], 2024

TO THE STOCKHOLDERS OF LM FUNDING AMERICA, INC.: |

|

[], 2024 |

This proxy statement and the form of proxy are delivered in connection with the solicitation by the Board of Directors of LM Funding America, Inc. (the “company,” “we,” “us,” or “our”), a Delaware corporation, of proxies to be voted at our below-described Annual Meeting of Stockholders and at any adjournments or postponements thereof. The Notice of Annual Meeting and this proxy statement are first being distributed or made available, as the case may be, on or about [●], 2024.

You are invited to attend our Annual Meeting of Stockholders on [], [], 2024, beginning at []. The Annual Meeting will be held at 1200 West Platt Street, Suite 100, Tampa, Florida 33606. Stockholders will be admitted beginning at [].

Your vote is very important. Therefore, whether you plan to attend the Annual Meeting or not and regardless of the number of shares you own, please vote electronically over the Internet, by telephone or, if you receive a paper copy of the proxy card by mail, by returning your signed proxy card in the envelope provided. If you later decide to attend the Annual Meeting and vote in person, you may revoke your proxy at that time.

At the meeting, the use of cameras, audio or video recording equipment, communications devices or similar equipment will be prohibited.

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on [], 2024:

This proxy statement and the 2023 Annual Report to Stockholders, as amended, are available at www.proxydocs.com/LMFA.

Upon your written request, we will provide you with a copy of our 2023 Annual Report on Form 10-K, as amended, including exhibits, free of charge. Send your request to LM Funding America, Inc., Attention: Bruce M. Rodgers, Chief Executive Officer, 1200 West Platt Street, Suite 100, Tampa, Florida 33606.

LM Funding America, Inc. •1200 West Platt Street, Suite 100, Tampa, FL 33606 • T (813) 222-8996 • F (813) 221-7909 • lmfunding.com

ABOUT THE ANNUAL MEETING

What is the purpose of the meeting?

The principal purposes of the Annual Meeting are to (i) elect two directors to the company’s Board of Directors; (ii) ratify the appointment of our outside auditors; (iii) approve an amendment and restatement of the LM Funding America, Inc. 2021 Omnibus Incentive Plan (the “Plan”); (iv) approve, in accordance with Nasdaq Listing Rule 5635(d), the issuance of more than 19.99% of our outstanding common stock issuable upon the exercise of common warrants; and (v) conduct an advisory vote on the compensation of our named executive officers as disclosed in this proxy statement. In addition, our management will report on our performance during 2023, discuss challenges ahead and respond to questions from stockholders.

Why did I receive a notice in the mail regarding the internet availability of proxy materials instead of a paper copy of proxy materials?

The rules of the Securities and Exchange Commission (the “SEC”) permit us to furnish proxy materials, including this proxy statement and the Annual Report, to our stockholders by providing access to such documents on the internet instead of mailing printed copies. Stockholders will not receive paper copies of the proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy Materials (the “Notice and Access Card”) provides instructions on how to access and review on the internet all of the proxy materials. The Notice and Access Card also instructs you as to how to authorize via the internet or telephone your proxy to vote your shares according to your voting instructions. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials described in the Notice and Access Card.

Who is entitled to vote?

Stockholders of record at the close of business on the record date, September 12, 2024, are entitled to vote in person or by proxy at the Annual Meeting. In general, stockholders are entitled to one vote per share on each matter voted upon. In an election for directors, however, stockholders are entitled to vote the number of shares they own for as many director candidates as there are directors to be elected. The Board of Directors has determined that the Board of Directors should include two Class II directorships. Accordingly, since two directors are to be elected at this Annual Meeting, in electing directors, each share will entitle the stockholder to two votes, one per director. Stockholders may not cumulate their votes. As of September 12, 2024, there were [] common shares outstanding.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of the holders of 33-1/3% of the shares outstanding will constitute a quorum, permitting us to conduct the business of the meeting.

What is the difference between a shareholder of record and a beneficial owner?

If your shares are registered directly in your name with our transfer agent, Vstock Transfer, LLC, then you are a “shareholder of record.” This Notice of Meeting and proxy statement has been provided directly to you by LM Funding America, Inc. You may vote by ballot at the meeting or vote by proxy. To vote by proxy, sign, date and return the enclosed proxy card or follow the instructions on the proxy card for voting by telephone or internet.

If your shares are held for you in a brokerage, bank or other institutional account (that is, held in “street name”), then you are not a shareholder of record. Rather, the institution is the shareholder of record and you are the “beneficial owner” of the shares. The accompanying Notice of Meeting and this proxy statement have been forwarded to you by that institution. If you complete and properly sign the accompanying proxy card and return it in the enclosed envelope, or follow the instructions on the proxy card for voting by telephone or internet, the institution will cause your shares to be voted in accordance with your instructions. If you are a beneficial owner of shares and wish to vote in person at the Annual Meeting, then you must obtain a proxy, executed in your favor, from the holder of record (the institution).

How do I vote?

By Ballot at the Meeting. If you are a shareholder of record and attend the Annual Meeting, you may vote in person by ballot at the Annual Meeting. To vote by ballot, you must register and confirm your shareholder status at the meeting. If the shareholder of record is a corporation, partnership, limited liability company or other entity of which you are an officer or other authorized person, then you should bring evidence of your authority to vote the shares on behalf of the entity. If your shares are held for you in a brokerage, bank or other institutional account (that is, in “street name”), you must obtain a proxy, executed in your favor, from that institution (the holder of record) to vote your beneficially-owned shares by ballot at the Annual Meeting. In the election of directors (Proposal No. 1), each share held by a shareholder of record will be entitled to two votes, one for each director to be elected.

1

By Proxy. If you complete, sign and return the accompanying proxy card or follow the instructions on the proxy card for voting by telephone or internet, then your shares will be voted as you direct. In the election of directors (Proposal No. 1), your options with respect to each director are to direct a vote “FOR”, “WITHHOLD ALL”, or “FOR ALL EXCEPT”.

If you are a shareholder of record, then you may opt to deliver your completed proxy card in person at the Annual Meeting.

Can I vote by telephone or internet?

Yes. If you follow the instructions on the proxy card for voting by telephone or internet, your shares will be voted as you direct.

Can I vote my shares by filling out and returning the Notice and Access Card?

No. The Notice and Access Card identifies the items to be voted on at the Annual Meeting, but you cannot vote by marking the Notice and Access Card and returning it. If you would like a paper proxy card, you should follow the instructions in the Notice and Access Card. The paper proxy card you receive will also provide instructions as to how to authorize via the internet or telephone your proxy to vote your shares according to your voting instructions. Alternatively, you can mark the paper proxy card with how you would like your shares voted, sign and date the proxy card, and return it in the envelope provided.

How Abstentions and Broker Non-Votes Are Treated

Abstentions will be counted as shares that are present for purposes of determining a quorum. For the election of directors, abstentions are excluded entirely from the vote and do not have any effect on the outcome. Broker non-votes occur when a broker or other nominee holding shares for a beneficial owner does not have discretionary voting power on a matter and has not received instructions from the beneficial owner. Broker non-votes are included in the determination of the number of shares represented at the Annual Meeting for purposes of determining whether a quorum is present. If you do not provide your broker or other nominee with instructions on how to vote your “street name” shares, your broker or nominee will not be permitted to vote them on nonroutine matters such as Proposals No. 1, No. 3, and No. 4. Shares subject to a broker non-vote will not be considered entitled to vote with respect to Proposals No. 1, No. 3, and No. 4. In tabulating the voting results for each of these proposals, shares that constitute broker non-votes are not considered cast or entitled to vote and will not affect the outcome of such proposals. Because Proposals No. 2 and No. 5 are routine matters upon which brokers have discretionary authority to vote, we do not expect broker non-votes to exist with respect to each such proposal.

What does it mean if I receive more than one Notice and Access Card or more than one set of proxy materials?

You will receive separate Notice and Access Cards when you own shares in different ways. For example, you may own shares individually, as a joint tenant, in an individual retirement account, in trust or in one or more brokerage accounts. You should follow the telephone or internet instructions on each Notice and Access Card or, if you elect to receive printed copies, on the proxy card. The instructions on each Notice and Access Card or proxy card, as applicable, may differ.

Can I change my vote or instruction?

Yes. You may follow the instructions on the proxy card to change your votes or instructions any time before midnight the day before the meeting. In addition, if you are a shareholder of record, you may revoke your proxy any time before your shares are voted by filing with the secretary of the company a written notice of revocation or submitting a duly executed proxy bearing a later date. If you file a notice of revocation, you may then vote (or abstain from voting) your shares in person at the Annual Meeting. If you submit a later dated proxy, then your shares will be voted in accordance with that later dated proxy. No such notice of revocation or later dated proxy, however, will be effective unless received by us at or before the Annual Meeting and before your shares have been voted. Unless the proxy is revoked, the shares represented thereby will be voted at the Annual Meeting or any adjournment thereof as indicated on the proxy card. Sending in a proxy does not affect your right to vote in person if you attend the meeting, although attendance at the meeting will not by itself revoke a previously granted proxy.

If I submit a proxy card, how will my shares be voted?

Your shares will be voted as you instruct on the proxy card.

What happens if I submit a proxy card and do not give specific voting instructions?

If you are a shareholder of record and sign and return the proxy card without indicating your instructions, your shares will be voted in accordance with the recommendations of the Board of Directors. With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, at their own discretion. As of the date this proxy statement went to print, we did not know of any other matters to be raised at the Annual Meeting.

2

What are the Board of Directors’ recommendations?

The Board of Directors recommends votes:

|

➢ |

FOR election of the following nominees for director positions: |

Douglas I. McCree

Martin Traber

|

➢ |

FOR the proposal to ratify the appointment of MaloneBailey, LLP as the company’s independent auditor to audit the company’s 2024 financial statements; |

|

➢ |

FOR the proposal to approve an amendment and restatement of the LM Funding America, Inc. 2021 Omnibus Incentive Plan; |

|

➢ |

FOR the proposal to approve, in accordance with Nasdaq Listing Rule 5635(d), the issuance of more than 19.99% of our outstanding common stock issuable upon the exercise of common warrants; |

|

➢ |

FOR the proposal to approve, on an advisory, non-binding basis, the compensation of our named executive officers; and |

|

➢

|

FOR the authority to transact such other business as may properly come before the stockholders at the Annual Meeting. |

What vote is required to approve each item?

The vote required to approve each matter to be voted on at the Annual Meeting is described below. We do not anticipate other matters coming to a vote at the Annual Meeting. Should any other matter be brought to a vote, the matter will be approved by the affirmative vote of the majority of the outstanding shares present in person or by proxy at the Annual Meeting and entitled to vote on the subject matter at a meeting at which a quorum is present unless a greater number of affirmative votes is required for approval of that matter under our Certificate of Incorporation, bylaws, or the Delaware General Corporation Law.

Under the Delaware General Corporation Law, an abstaining vote is considered present and entitled to vote and, therefore, is included for purposes of determining whether a quorum is present at the Annual Meeting. Pursuant to our bylaws, abstentions are not considered to be ‘‘votes cast’’ for the election of directors in Proposal No. 1 and will not affect the outcome of the election of directors. Abstentions are considered both present and “entitled to vote” on a matter. Accordingly, an abstention counts as a vote “against” any proposal where the voting standard is “a majority of the shares present and entitled to vote” or “a majority of the outstanding shares.”

A broker ‘‘non-vote’’ occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner. Under the Delaware General Corporation Law, a broker ‘‘non-vote’’ is not deemed to be a ‘‘vote cast’’ and, therefore, will not affect the outcome of the election of directors. While a broker ‘‘non-vote’’ is considered present for purposes of determining whether a quorum is present at the Annual Meeting, it is not considered ‘‘entitled to vote’’ and, therefore, not included in the tabulation of the voting results on matters requiring approval of the holders of a majority of the shares present in person or represented by proxy and entitled to vote. When the voting standard is approval of “a majority of the outstanding shares,” broker non-votes have the same effect as a vote “against” the proposal.

The required vote for each of the proposals expected to be acted upon at the Annual Meeting is summarized below:

Proposal No. 1 — Election of directors. Directors are elected by a plurality, with the two nominees obtaining the most votes being elected. Because there is no minimum vote required, abstentions and broker non-votes will be entirely excluded from the vote and will have no effect on its outcome. Under the plurality vote standard, any shares that are not voted, whether by abstention, broker non-votes or otherwise, will not affect the election of directors.

Proposal No. 2 — Ratification of independent registered public accounting firm. This proposal must be approved by the affirmative vote of the majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote thereon, assuming a quorum is present. Abstentions count as a vote “against” the proposal and broker non-votes will be entirely excluded from the vote and will have no effect on its outcome.

Proposal No. 3 — Approval of an amendment and restatement of the LM Funding America, Inc. 2021 Omnibus Incentive Plan. This proposal must be approved by the affirmative vote of the majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote thereon, assuming a quorum is present. Abstentions count as a vote “against” the proposal and broker non-votes will be entirely excluded from the vote and will have no effect on its outcome.

3

Proposal No. 4 – Approval, in accordance with Nasdaq Listing Rule 5635(d), of the issuance of more than 19.99% of our outstanding common stock issuable upon the exercise of common warrants. This proposal must be approved by the affirmative vote of the majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote thereon, assuming a quorum is present. Abstentions count as a vote “against” the proposal and broker non-votes will be entirely excluded from the vote and will have no effect on its outcome.

Proposal No. 5 - Approval, on an advisory, non-binding basis, of the compensation of our named executive officers. While this proposal is advisory in nature and non-binding, the Board will review the voting results and expects to take such results into consideration when making future decisions regarding executive compensation. Abstentions and broker non-votes will be entirely excluded from the vote and will have no effect on its outcome.

How will votes be counted?

All votes will be tabulated by the secretary of the company. We have engaged Mediant, a BetaNXT Business. to collect and tabulate proxy instructions.

Who is paying for the preparation and solicitation of proxies and how will solicitations be made?

We will pay the expenses of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees in person or by mail, telephone, facsimile or electronic transmission. We have requested brokerage houses and other custodians, nominees and fiduciaries to forward soliciting material to beneficial owners and have agreed to reimburse those institutions for their out-of-pocket expenses.

4

PROPOSAL 1

ELECTION OF DIRECTORS

Two directors are to be elected at the Annual Meeting. In accordance with the company’s Certificate of Incorporation, the Board of Directors is divided into three classes. Class I and Class II each consists of two directors, and Class III consists of three directors. All directors within a class have the same three-year terms of office. The class terms expire at successive annual meetings so that each year a class of directors is elected. The current terms of director classes are scheduled to expire at the annual meeting of stockholders in 2024 (Class II directors), 2025 (Class III directors), and 2026 (Class I directors). Accordingly, the Class II directors will be elected at this Annual Meeting. Each of the Class II directors elected at this Annual Meeting will be elected to serve a three-year term.

With the recommendation of the nominating and governance committee, the Board of Directors has nominated the following persons to stand for election as Class II directors at this Annual Meeting of Stockholders, with terms expiring at the third annual meeting of stockholders following their election:

Mr. Douglas I. McCree

Mr. Martin Traber

Each of the nominees for election as a director has consented to serve if elected. If, as a result of circumstances not now known or foreseen, one or more of the nominees should be unavailable or unwilling to serve as a director, proxies may be voted for the election of such other persons as the Board of Directors may select. The Board of Directors has no reason to believe that any of the nominees will be unable or unwilling to serve.

The persons named in the enclosed proxy card intend, unless otherwise directed, to vote such proxy “FOR” the election of Mr. Douglas I. McCree and Mr. Martin Traber as Class II directors of LM Funding America, Inc.

In the election of directors, the two highest recipients of “FOR” votes will be elected. A properly executed proxy card marked “WITHHOLD ALL" or “FOR ALL EXCEPT” with respect to the election of one or more director nominees will not be voted with respect to the director or directors indicated, even though it will be counted for purposes of determining whether there is a quorum present at the Annual Meeting.

RECOMMENDATION OF THE BOARD OF DIRECTORS

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR ELECTION OF EACH OF THE NOMINEES AS

DIRECTORS OF THE COMPANY

5

DIRECTORS

Set forth below is a summary of the background and experience of each director nominee and director as of the date of this proxy statement. There is no family relationship among any of the directors and/or executive officers of the company except as follows: Mr. Bruce M. Rodgers, our Chairman, Chief Executive Officer and President, and Ms. Carollinn Gould a director, have been married since 2004.

Directors Standing for Election (Class II)

Douglas I. McCree. Mr. McCree, age 59, has served as a director of the company since its initial public offering in October 2015. Mr. McCree has been with First Housing Development Corporation of Florida (“First Housing”) since 2000 and has served as its Chief Executive Officer since 2004. From 1987 through 2000, Mr. McCree held various positions with Bank of America, N.A. including Senior Vice President Affordable Housing Lending. Mr. McCree serves on numerous professional and civic boards. He received a B.S. from Vanderbilt University majoring in economics. Mr. McCree brings to the Board of Directors many years of banking experience and a strong perspective on public company operational requirements from his experience as Chief Executive Officer of First Housing.

Martin Traber. Mr. Traber, age 78, has served as a director of the company since his appointment on April 29, 2024. Mr. Traber previously served as one of our directors from October 2015 until January 2021. Beginning in January 2021, Mr. Traber served as a director of LMF Acquisition Opportunities, Inc., which was an indirect, wholly-owned subsidiary of the company, until its merger with Seastar Medical Holding Corporation in October 2022. He currently serves as a director of Mad Mobile, Inc., a global leader in point-of-sale modernization and technology solutions for the retail and restaurant industries, a position he has held since March 2019. Since February 2017, Mr. Traber has served as Chairman of Skyway Capital Markets, LLC a Tampa, Florida-based investment banking firm. Also, from 1994 until 2016, Mr. Traber was a partner of Foley & Lardner LLP, in Tampa, Florida, representing clients in securities law matters and corporate transactions. Mr. Traber was a founder of NorthStar Bank in Tampa, Florida and from 2007 to 2011 served as a member of the Board of Directors of that institution. From 2012 to 2013, he served on the Board of Directors of Exeter Trust Company in Portsmouth, New Hampshire. Mr. Traber holds a Bachelor of Arts and a Juris Doctor from Indiana University.

Mr. Traber brings considerable legal, financial and business experience to the Board of Directors. He has counseled and observed numerous businesses in a wide range of industries. The knowledge gained from his observations and his knowledge and experience in business transactions and securities law are considered important in monitoring the company’s performance and when we consider and pursue business acquisitions and financial transactions. As a corporate and securities lawyer, Mr. Traber has a fundamental understanding of governance principles and business ethics. His knowledge of other businesses and industries are useful in determining management and director compensation.

Directors whose present terms continue until the next annual meeting of stockholders following this Annual Meeting (Class I):

Bruce M. Rodgers. Mr. Rodgers, age 60, serves as the Chairman of the Board of Directors, Chief Executive Officer and President of the company. Prior to that, Mr. Rodgers owned Business Law Group, P.A. (“BLG”) and served as counsel to the founders of LM Funding, LLC, the company’s predecessor and wholly-owned subsidiary. Mr. Rodgers was instrumental in developing the company’s business model prior to inception. Mr. Rodgers transferred his interest in BLG to attorneys within the firm by means of redemption of such interest in BLG prior to the company going public in 2015. Mr. Rodgers is also a member of the Board of Directors of SeaStar Medical Holding Corporation (Nasdaq: ICU), a medical technology Company developing a platform therapy to reduce the consequences of hyperinflammation on vital organs. Mr. Rodgers is a former business transactions attorney and was an associate of Macfarlane, Ferguson, & McMullen, P.A. from 1991 to 1995 and a partner from 1995-1998 and was an equity partner of Foley & Lardner LLP from 1998 to 2003. Originally from Bowling Green, Kentucky, Mr. Rodgers holds an engineering degree from Vanderbilt University (1985) and a Juris Doctor, with honors, from the University of Florida (1991). Mr. Rodgers also served as an officer in the United States Navy from 1985-1989 rising to the rank of Lieutenant, Surface Warfare Officer. Mr. Rodgers is a member of the Florida Bar and holds an AV-Preeminent rating from Martindale Hubbell.

Mr. Rodgers brings to the Board of Directors considerable experience in business, management and law, and because of those experiences and his education, we believe that he possesses analytical and legal skills which are considered of importance to the operations of the company, the oversight of its performance and the evaluation of its future growth opportunities.

Carollinn Gould. Ms. Gould, age 61, co-founded LM Funding, LLC in January 2008, and currently serves as a director of the company. From January 2008 to September 30, 2020, Mrs. Gould served as Vice President General Manager, Secretary. Prior to joining LM Funding, LLC, Ms. Gould owned and operated a recruiting company specializing in the placement of financial services personnel. Prior to that, Ms. Gould worked at Outback Steakhouse (“OSI”) where she opened the first restaurant in 1989 and finished her career at OSI in 2006 as shared services controller for over 1,000 restaurants. Ms. Gould holds a Bachelor’s Degree in Business Management from Nova Southeastern University.

6

As a co-founder of LM Funding, LLC, Ms. Gould brings to our Board of Directors an encyclopedia of knowledge regarding the company’s business, operation, and procedures. While previously employed with the company, Ms. Gould managed all bank accounts of the company and managed its internal control systems. Ms. Gould also brings public company audit experience from her prior service as controller at OSI as well as a wealth of personnel management and human resources skills.

Directors whose present terms continue until the second annual meeting of stockholders following this Annual Meeting (Class III):

Andrew L. Graham. Mr. Graham, age 66, has served as a director of the company since its initial public offering in October 2015. Since June 2008, Mr. Graham has served as Vice President, General Counsel and Secretary of HCI Group, Inc. (NYSE:HCI). From 1999 to 2007, Mr. Graham served in various capacities, including as General Counsel, for Trinsic, Inc. (previously named Z-Tel Technologies, Inc.), a publicly-held provider of communications services headquartered in Tampa, Florida. From 2011 to 2016, Mr. Graham has served on the Internal Audit Committee of Hillsborough County, Florida. From 2007 to 2011, he served on the Board of Trustees of Hillsborough Community College, a state institution serving over 45,000 students annually.

Mr. Graham holds a Bachelor of Science, major in Accounting, from Florida State University and a Juris Doctor, as well as a Master of Laws (L.L.M.) in Taxation, from the University of Florida College of Law. Mr. Graham was licensed in Florida as a Certified Public Accountant from 1982 to 2001. As a Certified Public Accountant, he audited, reviewed and compiled financial statements and prepared tax returns. Mr. Graham’s experience serving as general counsel to publicly-held companies brings to our Board of Directors a comprehensive understanding of public company operations, financial reporting, disclosure and corporate governance, as well a perspective regarding potential acquisitions. With his accounting education and experience, he also brings a sophisticated understanding of accounting principles, auditing standards, internal accounting control and financial presentation and analysis.

Frederick Mills. Mr. Mills age 66, has served as a director of the company since August 2018 and has been a partner with the law firm Morrison & Mills, PA since 1989, a Tampa, Florida law firm that focuses on business law. Mr. Mills is also a founder and board member of Apex Labs, Inc. (toxicology lab in Tampa FL). Mr. Mills serves on numerous professional and civic boards. He received a B.S. from the University of Florida majoring in accounting and received a J.D. from the University of Florida. We believe that Mr. Mills brings to the Board of Directors many years of valuable business and financial experience from his past experience as a founding board member and Audit Committee Chairman for Nature Coast Bank (OTCQB:NCBF), which was a publicly-held company, and his business law practice.

Frank Silcox. Mr. Silcox, age 60, has served as a director of the company since January 2021. Mr. Silcox has been a Managing Director of Osprey Capital since March 2015. From 2008 until 2015, Mr. Silcox was co-founder and a Managing member of LM Funding, LLC, a wholly-owned subsidiary of the company. Mr. Silcox has owned FS Ventures since 2003, which makes a variety of investments in real estate ventures. Mr. Silcox holds a Bachelor of Science from the University of Tampa.

Mr. Silcox brings considerable legal, financial and business experience to the Board of Directors. He has counseled and observed numerous businesses in a wide range of industries. The knowledge gained from his observations and his knowledge and experience in business transactions are considered important in monitoring the company’s performance and when we consider and pursue business acquisitions and financial transactions. His knowledge of other businesses and industries are useful in determining management and director compensation.

Arrangements as to Selection and Nomination of Directors

We are aware of no arrangements as to the selection and nomination of directors.

Independent Directors

Based upon recommendations of our nominating and governance committee, the Board of Directors has determined that each of Messrs. Graham, McCree, Mills, Traber, and Silcox are “independent directors” meeting the independence tests set forth in the rules of the NASDAQ Stock Market and Rule 10A-3(b)(i) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including having no material relationship with the company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the company).

Board Diversity

On August 6, 2021, the SEC approved new board diversity rules for Nasdaq-listed companies. As of August 8, 2022, we are required to disclose on an annual basis our directors’ voluntary, self-identified demographic information using a standardized board diversity matrix (“Board Diversity Matrix”). To comply with this requirement, the following Board Diversity Matrix provides the self-identified demographic information for our directors as of [], 2024. Such information for the prior year can be found in our proxy

7

statement for the 2023 Annual Meeting. Each of the categories listed in the table below has the meaning as set forth in Nasdaq Rule 5605(f).

Board Diversity Matrix (as of [], 2024) |

||||

Total Number of Directors |

|

|

7 |

|

|

|

Female |

|

Male |

Part I: Gender Identity |

|

1 |

|

6 |

Part II: Demographic Background |

|

|

|

|

White |

|

1 |

|

6 |

In addition, the Nasdaq board diversity rules require that, by December 31, 2023, our Board have at least one diverse director that self-identifies as female, LGBTQ+, and/or an underrepresented minority, and by December 31, 2026, two diverse directors (including at least one that self-identifies as female and another who self-identifies as female, LGBTQ+, and/or an underrepresented minority). If we do not meet these criteria, we will be required to disclose the reasons for non-compliance. We intend to meet the requirements by the specified deadlines, provided that no assurances can be made that we will be able to attract and retain one or more directors meeting such requirements. Please note that the specific requirements and deadlines for the Nasdaq diversity rules vary depending on whether we continue to qualify as a smaller reporting company and the specific filing dates of the applicable proxy statement for our annual meetings, and as such, the preceding summary of the rules is subject to change from time to time.

DIRECTOR COMPENSATION

The compensation of our non-employee directors is determined by our board of directors, which solicits a recommendation from the Compensation Committee. Directors who are employees of the company do not receive any additional compensation for their service as directors.

On November 18, 2022, our board of directors adopted the LM Funding America, Inc, Non-Employee Director Compensation Program (the “Director Program”). Pursuant to the Director Program, each non-employee director of the company will receive an annual cash retainer of $66,000 (or $99,000 for audit committee members) payable in arrears in equal quarterly payments, pro-rated for partial years. Non-employee directors will also receive an annual stock option award to purchase a number of shares equal to $66,000 (or $99,000 for audit committee members) divided by the option exercise price (which will be equal to the fair market value of the company’s common stock on the date of grant), which annual awards will vest one-half on the 180th day after the grant date and one-half on the first anniversary of the grant date. The annual option award will be granted on the day of the company’s annual stockholder meeting each year. Upon initial election or appointment to our board of directors (or on such later date as is determined by the Board of Directors), non-employee directors will also automatically receive stock options to purchase shares under the company’s equity incentive plan equal to $25,000 divided by the exercise price of the option, with such exercise price being equal to the grant date fair value of the company’s common stock.

The following table sets forth information with respect to compensation earned by each of our directors (other than those also serving as a “named executive officer”) during the year ended December 31, 2023 and 2022.

8

|

|

|

Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earned or |

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid in |

|

|

Option |

|

|

|

|

|

||

|

|

|

Cash |

|

|

Awards |

|

|

|

|

|

||

Name |

Year |

|

($)(1) |

|

|

($) |

|

|

Total ($) |

|

|||

Carollinn Gould |

2023 |

|

$ |

66,000 |

|

|

$ |

- |

|

|

$ |

66,000 |

|

|

2022 |

|

$ |

60,000 |

|

|

$ |

62,644 |

|

|

$ |

122,644 |

|

Andrew Graham |

2023 |

|

$ |

99,000 |

|

|

$ |

- |

|

|

$ |

99,000 |

|

|

2022 |

|

$ |

92,375 |

|

|

$ |

93,966 |

|

|

$ |

186,341 |

|

Fred Mills |

2023 |

|

$ |

99,000 |

|

|

$ |

- |

|

|

$ |

99,000 |

|

|

2022 |

|

$ |

92,375 |

|

|

$ |

93,966 |

|

|

$ |

186,341 |

|

Douglas I. McCree |

2023 |

|

$ |

99,000 |

|

|

$ |

- |

|

|

$ |

99,000 |

|

|

2022 |

|

$ |

92,375 |

|

|

$ |

93,966 |

|

|

$ |

186,341 |

|

Frank Silcox |

2023 |

|

$ |

66,000 |

|

|

$ |

- |

|

|

$ |

66,000 |

|

|

2022 |

|

$ |

62,375 |

|

|

$ |

62,644 |

|

|

$ |

125,019 |

|

Todd Zhang* |

2023 |

|

$ |

66,000 |

|

|

$ |

- |

|

|

$ |

66,000 |

|

|

2022 |

|

$ |

25,000 |

|

|

$ |

23,881 |

|

|

$ |

48,881 |

|

Martin Traber** |

2023 |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

2022 |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

Represents compensation for the period from January 1, 2023 through December 31, 2023 and January 1, 2022 through December 31, 2022.

* Mr. Zhang was appointed to the board in December 2022 and resigned from the board effective April 25, 2024.

**Mr. Traber was appointed to the Board on April 29, 2024 and, as such, did not receive any compensation during fiscal 2023 or 2022.

EXECUTIVE OFFICERS

The following table provides information with respect to our executive officers as of [], 2024:

Name |

|

Age |

|

Title |

Bruce M. Rodgers |

|

60 |

|

Chairman, Chief Executive Officer and President |

Richard Russell |

|

63 |

|

Chief Financial Officer |

Ryan Duran |

|

39 |

|

Vice President of Operations |

|

|

|

|

|

Bruce M. Rodgers. Mr. Rodgers background and experience is contained above in the section of this Proxy Statement entitled “Directors.”

Richard Russell. Mr. Russell, age 63, has served as Chief Financial Officer of the company since November 2017. Prior, since 2016, he provided financial and accounting consulting services with a focus on technical and external reporting, internal auditing, mergers & acquisitions, risk management, and CFO and controller services. Mr. Russell also served as Chief Financial Officer for Mission Health Communities from 2013 to 2016 and, before that, Mr. Russell served in a variety of roles for Cott Corporation from 2007 to 2013, including Senior Director of Finance, Senior Director of Internal Auditing, and Assistant Corporate Controller. Mr. Russell’s extensive professional experience with public companies includes his position as Director of Financial Reporting and Internal Controls for Quality Distribution a previously listed publicly held company traded on the Nasdaq Stock Market under the symbol “QLTY” and as Danka’s Director of Reporting from 2001 to 2004 a previously listed publicly held office imaging company traded on both the London Stock Exchange and the Nasdaq Stock Exchange (“DANKY”). Mr. Russell also serves as a director of SeaStar Medical Holding Corporation (Nasdaq: ICU), a medical technology company developing a platform therapy to reduce the consequences of hyperinflammation on vital organs. Mr. Russell also previously served on a part-time basis as Chief Financial Officer of Generation Income Properties Inc., which is a publicly traded REIT traded on the Nasdaq Market, under the symbol "GIPR" from December 2019 to February 2022. Mr. Russell earned his Bachelor of Science in accounting and a Master’s in tax accounting from the University of Alabama, a Bachelor of Arts in international studies from the University of South Florida, and a Master’s in business administration from the University of Tampa. On March 1, 2020, Mr. Russell was appointed to the board of directors for Trident Brands Inc., a publicly held consumer products company traded on the OTC market under the symbol "TDNT". Mr. Russell was also Chairman of the Hillsborough County Internal Audit Committee and had been a member of the Committee from September 2016 to April 2021. He was reappointed to the Committee in October 2021.

9

Ryan Duran. Mr. Duran, age 39, currently serves as Vice President of Operations of the company and joined the company in March 2015. Prior to joining the company, Mr. Duran served as Operations Manager of Business Law Group, since 2008. Mr. Duran holds a bachelor’s degree in real estate and finance from Florida State University.

We are aware of no arrangements as to the selection or appointment of executive officers.

EXECUTIVE COMPENSATION AND RELATED INFORMATION

SUMMARY COMPENSATION TABLE

The following table provides summary information concerning compensation for services rendered in all capacities awarded to, earned by or paid to our named executive officers during the years ended December 31, 2023 and 2022. The table does not include compensation for 2023 or 2022 for a named executive officer if such officer was not employed by the Company in 2023 or 2022.

|

Fiscal |

|

Salary |

|

Bonus |

|

Stock Awards |

|

Option Awards |

|

All Other Compensation |

|

|

Total |

|||||||

Name and Principal Position |

Year |

|

($) |

|

($) |

|

($) |

|

($) |

|

($)(1) |

|

|

|

($) |

||||||

Bruce Rodgers |

2023 |

|

$ |

825,000 |

|

$ |

- |

|

$ |

488,345 |

|

$ |

356,503 |

|

$ |

24,860 |

|

$ |

1,694,708 |

||

Chairman, CEO and President |

2022 |

|

$ |

750,000 |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

10,571 |

|

$ |

760,571 |

||

Richard Russell |

2023 |

|

$ |

550,000 |

|

$ |

- |

|

$ |

488,345 |

|

$ |

356,503 |

|

$ |

48,467 |

|

$ |

1,443,315 |

||

Chief Financial Officer |

2022 |

|

$ |

500,000 |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

32,559 |

|

$ |

532,559 |

||

Ryan Duran |

2023 |

|

$ |

192,500 |

|

$ |

- |

|

$ |

122,086 |

|

$ |

89,126 |

|

$ |

40,217 |

|

$ |

443,929 |

||

Vice President of Operations |

2022 |

|

$ |

175,000 |

|

$ |

75,000 |

|

$ |

- |

|

$ |

- |

|

$ |

32,559 |

|

$ |

282,559 |

||

(1) These amounts consist of health insurance premiums, dental & vision insurance premiums paid by the Company in excess of non-executive contribution and 401K Company match.

Employment Agreements

Certain executives’ compensation and other arrangements are set forth in employment agreements. These employment agreements are described below.

Bruce M. Rodgers.

In October 2021, Mr. Rodgers’ entered into an amended and restated employment agreement with the company (the “Restated Rodgers Agreement”) which provides for an annual base salary of $750,000. The Restated Rodgers Agreement provided for a grant of 48,662 shares of the company’s common stock that were paid in February 2022, with an amount of shares equal to the taxes payable by Mr. Rodgers with respect to the grant having been withheld to satisfy such taxes. The Restated Rodgers Agreement originally provided for certain bonuses upon a change of control of the company (as defined in the Restated Rodgers Agreement), but as stated below, such change-of-control provisions were eliminated in November 2022. Pursuant to the Restated Rodgers Agreement, Mr. Rodgers was also originally entitled to receive his applicable base salary for a period of 36 months after termination if such termination were “without cause” or if he terminated his own employment for a “good reason event,” as those terms are defined in the Restated Rodgers Agreement, in addition to any accrued bonus as of the termination date and the accelerated vesting of any unvested options. However, such severance provisions were eliminated and replaced in November 2022, as described below. The Restated Rodgers Agreement also contains certain non-competition covenants and confidentiality provisions.

On November 16, 2022, the Restated Rodgers Agreement was amended and modified (the “Rodgers Amendment”) by deleting provisions in the Restated Rodgers Agreement that granted Mr. Rodgers certain bonuses upon a change of control of the company. Further, the Rodgers Amendment modifies the severance provisions of the Restated Rodgers Agreement to provide that, upon the termination of Mr. Rodgers by the company without cause (or upon termination by him of his own employment upon a “good reason event,” as defined in the Restated Rodgers Agreement), he will be entitled to receive, in addition to any accrued salary and bonus, the sum of two years of his salary plus the average bonus paid for the preceding three years, which sum will be paid over a period of two years, as well as reimbursements for premium payments paid or payable by Mr. Rodgers for continuing healthcare coverage for up to 24 months following his termination.

Richard Russell.

In October 2021, Mr. Russell entered into an amended and restated employment agreement with the company (the “Restated Russell Agreement”) which provides for an annual base salary of $500,000. The Restated Russell Agreement provided for a grant of 25,279 shares of the company’s common stock that were paid in February 2022, with an amount of shares equal to the taxes payable by Mr. Russell with respect to the grant having been withheld to satisfy such taxes. The Restated Russell Agreement originally provided for certain bonuses upon a change of control of the company (as defined in the Restated Russell Agreement), but as stated below, such change-of-control provisions were eliminated in November 2022. Pursuant to the Restated Russell Agreement, Mr. Russell was also originally entitled to receive his applicable base salary for a period of 36 months after termination if such termination

10

were “without cause” or if he terminated his own employment for a “good reason event,” as those terms are defined in the Restated Russell Agreement, in addition to any accrued bonus as of the termination date and the accelerated vesting of any unvested options. However, such severance provisions were eliminated and replaced in November 2022, as described below. The Restated Russell Agreement also contains certain non-competition covenants and confidentiality provisions.

On November 16, 2022, the Restated Russell Agreement was amended and modified (the “Russell Amendment”) by deleting provisions in the Restated Russell Agreement that granted Mr. Russell certain bonuses upon a change of control of the company. Further, the Russell Amendment modifies the severance provisions of the Restated Russell Agreement to provide that, upon the termination of Mr. Russell by the company without cause (or upon termination by him of his own employment upon a “good reason event,” as defined in the Restated Russell Agreement), he will be entitled to receive, in addition to any accrued salary and bonus, the sum of two years of his salary plus the average bonus paid for the preceding three years, which sum will be paid over a period of two years, as well as reimbursements for premium payments paid or payable by Mr. Russell for continuing healthcare coverage for up to 24 months following his termination.

Ryan Duran.

On October 27, 2021, the company and Ryan Duran entered into an employment agreement under which Mr. Duran serves as the Executive Vice President of Operations of the company. Mr. Duran’s employment agreement provides for an annual base salary of $175,000, and it provides that Mr. Duran may be granted annual bonuses at the discretion of the Board of Directors and may participate in the company’s equity incentive plans on the same terms as other senior executives. The agreement provides that Mr. Duran is entitled to participate in all of the company’s pension, life insurance, health insurance, disability insurance and other benefit plans on the same basis as the company’s other employee officers participate. The term of Mr. Duran’s employment agreement is through September 30, 2023 and is automatically renewed each year unless notice of non-renewal is provided by the company or Mr. Duran at least 30 days prior to the renewal date. Mr. Duran will be entitled to a lump sum severance payment of three times his base salary if he is terminated “without cause” (including a non-renewal of the agreement by the company) or he terminates his own employment for a “good reason event,” as those terms are defined in the agreement, in addition to any accrued bonus as of the termination date and the accelerated vesting of any unvested options and other equity awards. Mr. Duran’s employment agreement contains certain non-competition covenants and confidentiality provisions.

Option Cancellation Agreements

On November 18, 2022, the company entered into Stock Option Cancellation Agreements (the “Cancellation Agreements”) with Mr. Rodgers and Mr. Russell pursuant to which they surrendered and cancelled certain previously granted stock options to purchase shares of the company’s common stock in order to make additional shares available under the company’s 2021 Omnibus Incentive Plan for future equity grants to Company personnel. Pursuant to the terms of the Cancellation Agreements, Mr. Rodgers, Mr. Russell, and the company acknowledged and agreed that the surrender and cancellation of the Cancelled Options was without any expectation to receive, and was without any obligation on the company to pay or grant, any cash, equity awards or other consideration presently or in the future in regard to the cancellation of the cancelled options.

Outstanding Equity Awards at Fiscal Year-End

The following table provides information on exercisable and unexercisable options and unvested stock awards held by the named executive officers on December 31, 2023.

|

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price ($) |

Option Expiration Date |

Number of Shares of Units That Have Not Vested |

Market value of shares of units of stock that have not vested ($) |

Equity incentive plan awards: Number of unearned shares, units or other rights that have not vested |

Equity incentive plan awards: Market or payout value of unearned shares, units or other rights that have not vested |

Bruce Rodgers |

- |

- |

- |

- |

36,111 |

133,571 |

- |

- |

Bruce Rodgers |

83,333 |

83,333 |

4.51 |

4/20/33 |

- |

- |

- |

- |

Richard Russell |

- |

- |

- |

- |

36,111 |

133,571 |

- |

- |

Richard Russell |

83,333 |

83,333 |

4.51 |

4/20/33 |

|

|

|

|

11

Richard Russell |

83 |

- |

3,750 |

11/29/2027 |

- |

- |

- |

- |

Richard Russell |

83 |

- |

300 |

5/29/2028 |

- |

- |

- |

- |

Ryan Duran |

- |

- |

- |

- |

9,028 |

33,394 |

- |

- |

Ryan Duran |

20,833 |

20,833 |

4.51 |

4/20/33 |

- |

- |

- |

- |

Ryan Duran |

21,065 |

8,120 |

35.70 |

10/28/2031 |

- |

- |

- |

- |

Ryan Duran |

14 |

- |

3,000 |

1/4/2026 |

- |

- |

- |

- |

Ryan Duran |

28 |

- |

300 |

5/29/2028 |

- |

- |

- |

- |

Indemnification Agreements

We have entered into indemnification agreements with each of our directors and executive officers. These agreements, among other things, require us to indemnify each director and executive officer to the fullest extent permitted by Delaware law, including indemnification expenses such as attorneys’ fees, judgments, fines and settlement amounts incurred by the director or executive officer in any action or proceeding, including any action or proceeding by or in right of us, arising out of the person’s services as a director or executive officer. The form of indemnification agreement was filed as an exhibit to the Registration Statement on Form S-1 filed on June 25, 2015.

Pay Versus Performance

The following table sets forth the compensation information of our principal executive officer (the “PEO”), and the average compensation information of our other named executive officers (“Non-PEO NEOs”), both as reported in the Summary Compensation Table in this proxy statement and with certain adjustments to reflect the “compensation actually paid” (“CAP”, as calculated in accordance with the SEC rules) to such individuals, and certain measures of the company’s financial performance, for each of fiscal years 2023, 2022, and 2021.

Year |

Summary Compensation Table Total for PEO ($) (1) |

Compensation Actually Paid to PEO ($) (2) (3) |

Average Summary Compensation Table Total for Non-PEO NEOs ($) (1) |

Average Compensation Actually Paid to Non-PEO NEOs ($) (2) (3) |

Value of Initial Fixed $100 Investment Based on the Total Shareholder Return of the Company ($) |

Net (Loss) Income ($ in thousands) |

2023 |

1,694,708 |

1,250,693 |

943,622 |

666,113 |

18.41 |

(15,944) |

2022 |

760,571 |

597,551 |

407,559 |

365,217 |

16.47 |

(29,240) |

2021 |

11,315,193 |

1,672,043 |

6,092,457 |

835,547 |

145.07 |

4,759 |

(1) The PEO for each of the years presented is Bruce Rodgers. The Non-PEO NEOs for whom the average compensation is presented in this table for each of the years presented are Richard Russell and Ryan Duran. |

||||||

(2) The amounts shown as CAP have been calculated in accordance with Item 402(v) of Regulation S-K and do not reflect compensation actually realized or received by the company’s NEO. These amounts reflect total compensation as set forth in the Summary Compensation Table for each year, adjusted as described in footnote 3, below. |

||||||

(3) CAP reflects the exclusions and inclusions of certain amounts for the PEO and Non-PEO NEOs as set forth below. Equity values are calculated in accordance with FASB ASC Topic 718.

|

||||||

12

PEO |

|||

Year |

2021 |

2022 |

2023 |

SCT Total Compensation ($) |

11,315,193 |

760,571 |

1,694,708 |

Less: Stock and Option Award Values Reported in SCT for the Covered Year ($) |

(9,834,875) |

- |

(844,848) |

Plus: Fair Value for Stock and Option Awards Granted in the Covered Year that are Outstanding and Unvested at End of Year ($) |

- |

- |

133,611 |

Change in Fair Value of Outstanding Unvested Stock and Option Awards from Prior Years ($) |

- |

- |

- |

Fair Value as of Vesting Date for Awards Granted that Vested in Same Year ($) |

191,725 |

- |

267,222 |

Change in Fair Value of Stock and Option Awards from Prior years that Vested in the Covered Year ($) |

- |

(163,020) |

- |

Less: Fair Value of Stock and Option Awards Forfeited during the covered Year ($) |

- |

- |

- |

Less: Aggregate Change in Actuarial Present Value of Accumulated Benefit Under Pension Plans ($) |

- |

- |

- |

Plus: Aggregate Service Cost and Prior Service Cost for Pension Plans ($) |

- |

- |

- |

Compensation Actually Paid ($) |

1,672,043 |

597,551 |

1,250,693 |

Non-PEO |

|||

Year |

2021 |

2022 |

2023 |

SCT Total Compensation ($) |

12,184,913 |

815,118 |

1,887,244 |

Less: Stock and Option Award Values Reported in SCT for the Covered Year ($) |

(10,613,419) |

- |

(1,056,060) |

Plus: Fair Value for Stock and Option Awards Granted in the Covered Year that are Outstanding and Unvested at End of Year ($) |

- |

- |

167,014 |

Change in Fair Value of Outstanding Unvested Stock and Option Awards from Prior Years ($) |

- |

- |

- |

Fair Value as of Vesting Date for Awards Granted that Vested in Same Year ($) |

99,599 |

- |

334,028 |

Change in Fair Value of Stock and Option Awards from Prior years that Vested in the Covered Year ($) |

- |

(84,684) |

- |

Less: Fair Value of Stock and Option Awards Forfeited during the covered Year ($) |

- |

- |

- |

Less: Aggregate Change in Actuarial Present Value of Accumulated Benefit Under Pension Plans ($ |

- |

- |

- |

Plus: Aggregate Service Cost and Prior Service Cost for Pension Plans ($) |

- |

- |

- |

Compensation Actually Paid ($) |

1,671,093 |

730,434 |

1,332,226 |

13

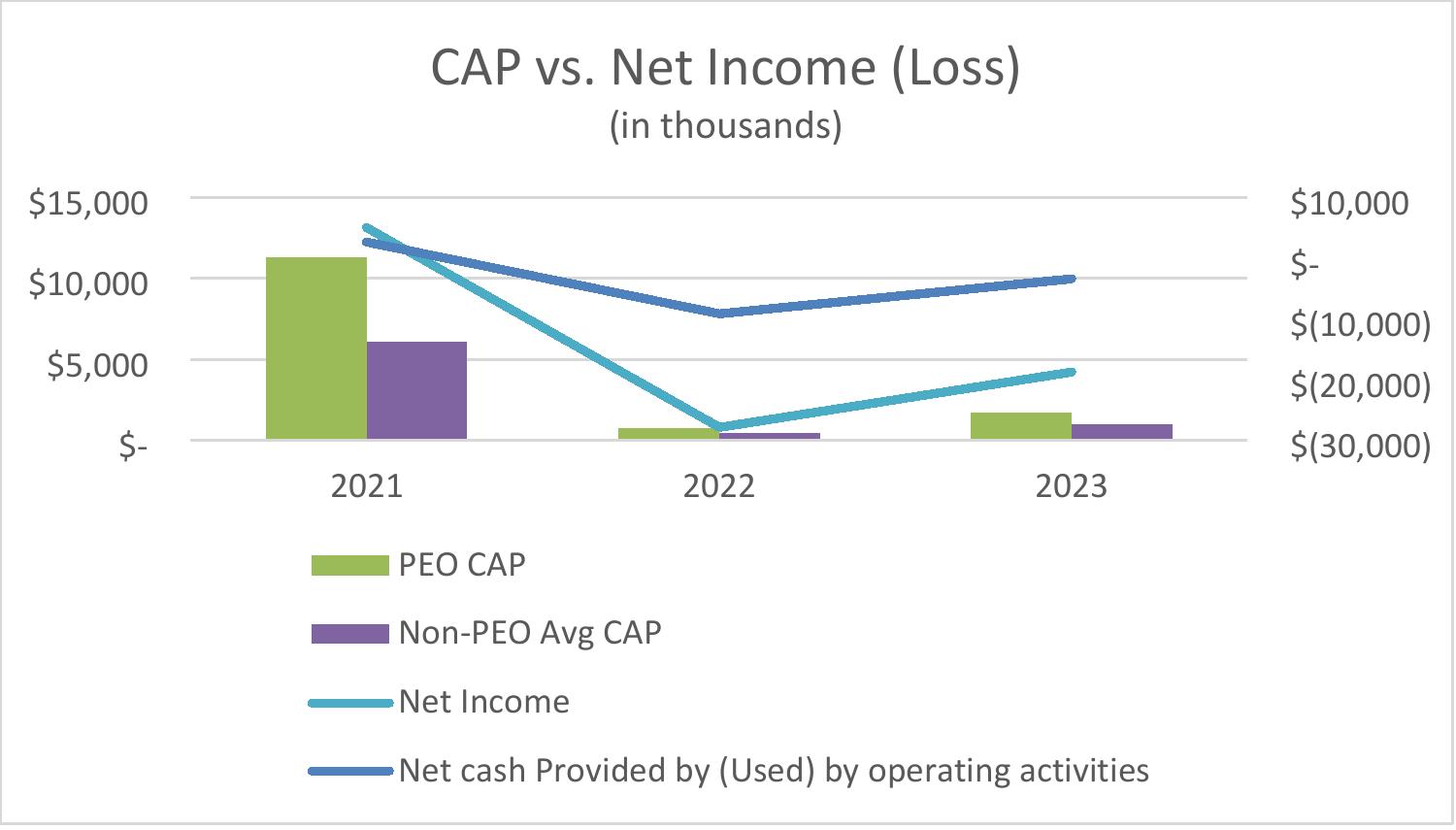

Description of Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Net Loss

The following chart sets forth the relationship between CAP to our PEO, the average CAP to our Non-PEO NEOs, and net loss attributable to the company over the three most recently completed fiscal years:

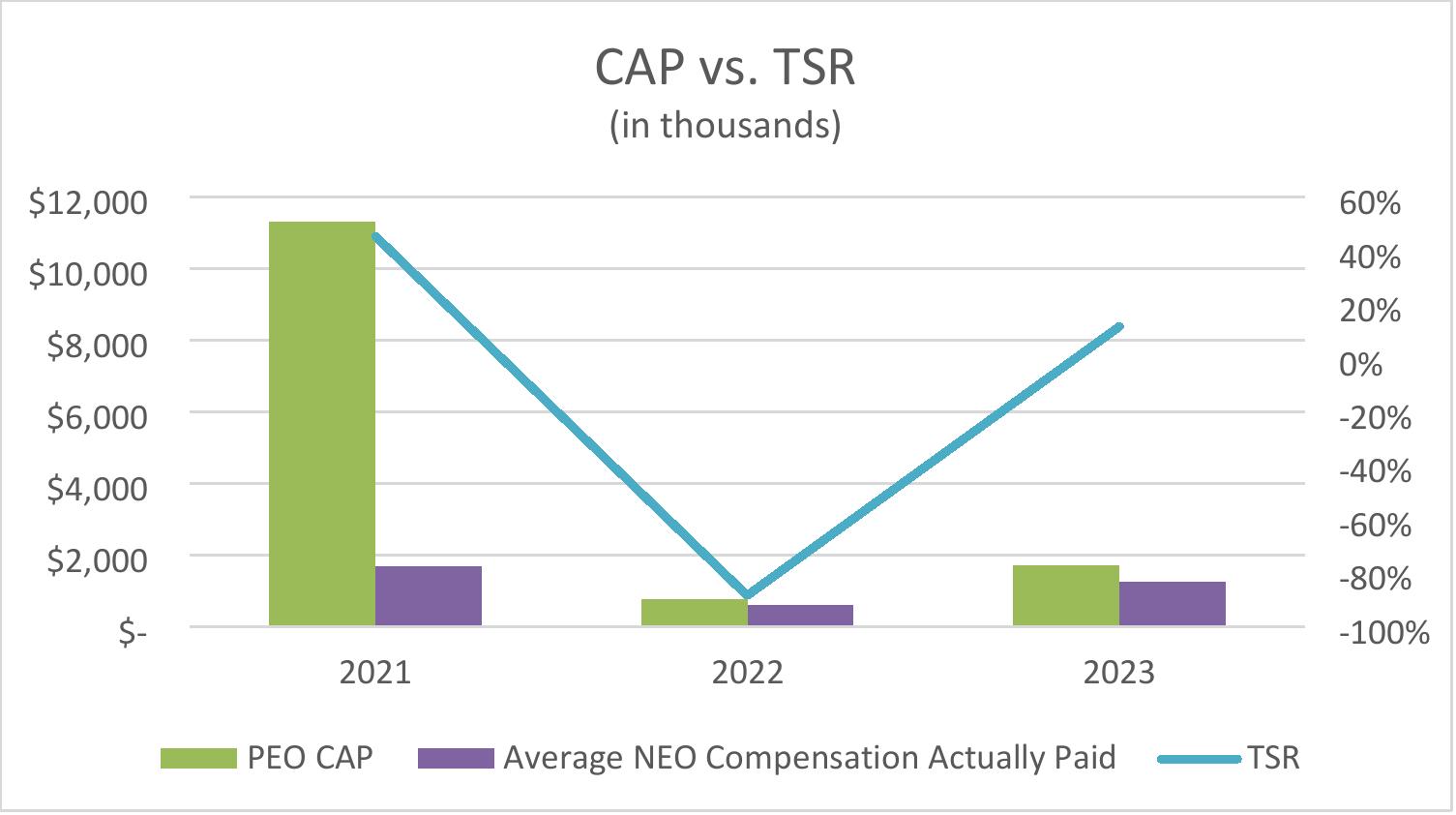

Description of Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Company Total Shareholder Return (“TSR”)

The following chart sets forth the relationship between CAP to our PEO, the average CAP to our Non-PEO NEOs, and the company’s cumulative TSR over the three most recently completed fiscal years:

TRANSACTIONS WITH RELATED PERSONS

Association Collection and Distribution Services

The Company engaged BLG on behalf of many of its Association clients to service and collect the accounts and to distribute the proceeds as required by Florida law and the provisions of the purchase agreements between the Company and the Associations. On February 1, 2022, the Company consented to the assignment by BLG to the law firm BLG Association Law, PLLC (“BLGAL”), of

14

the Services Agreement, dated April 15, 2015, previously entered into by and between the Company and BLG (the “Services Agreement”). One of our directors, Ms. Gould, served as the General Manager of BLG and also currently serves as the General Manager of BLGAL. Initially, the Company paid BLG a fixed monthly fee of $82,000 per month for services rendered. On February 1, 2022, the Services Agreement was amended to reduce the monthly compensation payable under the Services Agreement to $53,000, and on March 28, 2024, the Services Agreement was amended to further reduce the monthly compensation payable under the Services Agreement to $43,000. Further, a termination fee of $150,000 was paid in February 2022 to BLG in connection with the assignment of the Services Agreement.

ADVERSE INTERESTS

We are not aware of any material proceedings in which an executive officer or director is a party adverse to the company or has a material interest adverse to the company.

INVOLVEMENT IN CERTAIN LEGAL PROCEEDINGS

To our knowledge, none of our current directors or executive officers has, during the past ten years:

Except as set forth above and in our discussion above in “Adverse Interests,” none of our directors or executive officers has been involved in any transactions with us or any of our directors, executive officers, affiliates or associates which are required to be disclosed pursuant to the rules and regulations of the SEC.

DELINQUENT SECTION 16(A) REPORTS

Section 16(a) of Exchange Act requires the company’s directors and officers, and persons who own more than 10% of a registered class of the company’s equity securities, to file initial reports of ownership and reports of changes in ownership with the SEC. Such persons also are required to furnish the company with copies of all Section 16(a) reports they file.

Based solely on its review of the copies of such reports received by it with respect to fiscal year 2023 or written representations from certain reporting persons, the company believes that all filing requirements applicable to its directors and officers and persons who own more than 10% of a registered class of the company’s equity securities have been complied with, on a timely basis, for fiscal year 2023, except that Mint Capital Advisors Ltd filed a late Form 3 on October 5, 2023.

CODE OF ETHICS

We have adopted a code of ethics applicable to all employees and directors, including our Chief Executive Officer and Chief Financial Officer. We have posted the text of our code of ethics to our internet website: ir.lmfunding.com by clicking “Investors” at the top, hovering over “Governance”, and then clicking “Governance Documents”. We intend to disclose any change to or waiver from our code of ethics by posting such change or waiver to our internet website within the same section as described above.

CORPORATE GOVERNANCE GUIDELINES

We have adopted Corporate Governance Guidelines to promote effective governance of the company. A current copy of our Corporate Governance Guidelines is available on our website ir.lmfunding.com by clicking “Investors” at the top, hovering over “Governance”, and then clicking “Governance Documents”.

15

ANTI-HEDGING POLICIES

Our Board of Directors has adopted an Insider Trading Policy which applies to all of our directors, officers and designated employees. The policy prohibits our directors, officers and designated employees from engaging in hedging transactions, short sales and transactions in publicly traded options, such as puts, calls and other derivatives, involving our equity securities.

MEETINGS OF THE BOARD OF DIRECTORS

During 2023, our Board of Directors held seven meetings. All directors attended at least 75% of the meetings of the Board of Directors and the committees on which they served during 2023. In addition, the independent directors met in executive session periodically in 2023. We have not established a policy with regard to the attendance of board members at annual stockholder meetings. We have not established a policy with regard to the attendance of board members at annual stockholder meetings.

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

We have established procedures by which stockholders may communicate with members of the Board of Directors, individually or as a group. Stockholders wishing to communicate with the Board of Directors or a specified member of the Board may send written communications addressed to: Board of Directors, LM Funding America, Inc., Attention: Bruce M. Rodgers, Chief Executive Officer, 1200 West Platt Street, Suite 100, Tampa, Florida 33606. The mailing envelope should clearly specify the intended recipient or recipients, which may be the Board of Directors as a group or an individual member of the Board. The communication should include the stockholder’s name and the number of shares owned. Communications that are not racially, ethically or religiously offensive, commercial, pornographic, obscene, vulgar, profane, defamatory, abusive, harassing, threatening, malicious, false or frivolous in nature will be promptly forwarded to the specified members of the Board of Directors. We have also established procedures by which all interested parties (not just stockholders) may communicate directly with our non-management or independent directors as a group. Any interested party wishing to communicate with our non-management or independent directors as a group may send written communications addressed to: Board of Directors, LM Funding America, Inc., Attention: Bruce M. Rodgers, Chief Executive Officer, 1200 West Platt Street, Suite 100, Tampa, Florida 33606. The mailing envelope should clearly specify the intended recipients, which may be the non-management directors or the independent directors as a group. The envelope will be promptly forwarded for distribution to the intended recipients.

COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors has an audit committee, a compensation committee and a nominating and governance committee.

Audit Committee

The Company has a separately-designated standing Audit Committee established in accordance with the Exchange Act. The Audit Committee’s responsibilities include the following:

|

|

1) assisting our Board of Directors in its oversight of the quality and integrity of our accounting, auditing, and reporting practices; |

|

|

2) overseeing the work of our internal accounting and auditing processes; |

|

|

3) discussing with management our processes to manage business and financial risk; |

|

|

4) making appointment, compensation, and retention decisions regarding, and overseeing the independent registered public accounting firm engaged to prepare or issue audit reports on our financial statements; |

|

|

5) establishing and reviewing the adequacy of procedures for the receipt, retention and treatment of complaints received by our Company regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters; |

|

|

6) reviewing and discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures; and |

|

|

7) conducting an appropriate review and approval of all related party transactions for potential conflict of interest situations on an ongoing basis. |

The Audit Committee is composed of three members: Andrew Graham, its chairman, Fred Mills and Douglas I. McCree. Since our common shares are listed on Nasdaq Capital Market, we are governed by its listing standards. Accordingly, the members of the Audit Committee are all “independent directors” pursuant to the definition contained in Rule 5605(a)(2) of the NASDAQ and the criteria for independence set forth in Rule 10A-3(b)(1) of the Exchange Act. The Board of Directors has determined that Mr. Graham is an audit committee financial expert within the meaning of applicable SEC rules. The Audit Committee met formally four times during 2023. The Board of Directors has adopted a written Audit Committee Charter.

16

A current copy of the charter is available on our website www.lmfunding.com by clicking “Investors” and then “Governance.”

Compensation Committee

The Compensation Committee’s responsibilities include the following:

The Compensation Committee has the authority to determine the compensation of the named executive officers, except the Chief Executive Officer. The Compensation Committee makes recommendations to the Board of Directors for non-employee directors and the Chief Executive Officer compensation and equity awards under the Company’s equity plans. At least annually, the Compensation Committee considers the results of the Company’s operations and its financial position and makes compensation determinations. The Compensation Committee did engage consultants in determining compensation paid to executives in 2023 but did not engage or rely on consultants in determining compensation paid to executive officers in 2022 and 2021, instead relying on the judgment and knowledge of its own members. The Compensation Committee is composed of three members: Douglas I. McCree, its chairman, Fred Mills, and Frank Silcox, each of whom have been determined to be “independent” within the meaning of the SEC and NASDAQ regulations and is a “non-employee director” as defined in Section 16b-3 of the Exchange Act. The Board of Directors has adopted a formal Compensation Committee charter. The Compensation Committee met formally four times in 2023.

A current copy of the charter is available on our website www.lmfunding.com by clicking “Investors” and then “Governance.”

Nominating and Governance Committee

The Nominating and Governance Committee’s responsibilities include the following:

|

(1) establishing criteria for selection of potential directors, taking into account all factors it considers appropriate; |

|

(2) identifying and selecting individuals believed to be qualified as candidates to serve on the board and recommending to the board candidates to stand for election as directors at the annual meeting of shareholders or, if applicable, at a special meeting of the shareholders; |

|

(3) evaluating and ensuring the independence of each member of each committee of the board required to be composed of independent directors; |

|

(4) developing and recommending to the board a set of corporate governance principles appropriate for our Company and consistent with the applicable laws, regulations, and listing requirements; |

|

(5) developing and recommending to the board a code of conduct for our Company’s directors, officers, and employees; |

|

(6) ensuring that the company makes all appropriate disclosures regarding the process for nominating candidates for election to the board, including any process for shareholder nominations, the criteria established by the committee for candidates for nomination for election to the board, and any other disclosures required by applicable laws, regulations, or listing standards; and |

|

(7) reporting regularly to the board (i) regarding meetings of the committee, (ii) with respect to such other matters as are relevant to the committee’s discharge of its responsibilities, and (iii) with respect to such recommendations as the committee may deem appropriate. |

17

The Nominating and Governance Committee is composed of three members: Andrew Graham, its chairman, Douglas I. McCree, and Martin Traber. The Nominating and Governance Committee had seven meetings in 2023. The Board of Directors has adopted a written Nominating and Governance Committee Charter.

A current copy of the charter is available on our website www.lmfunding.com by clicking “Investors” and then “Governance.”