Exhibit 2.1

ASSET PURCHASE AGREEMENT

between

TECH INFRASTRUCTURE JV I LLC (AS SELLER)

and

US DIGITAL MINING AND HOSTING OKLAHOMA LLC (AS BUYER)

dated as of

November 14, 2024

TABLE OF CONTENTS

ARTICLE I DEFINITIONS |

1 |

|

ARTICLE II PURCHASE AND SALE |

7 |

|

Section 2.01 |

Purchase and Sale of Assets |

7 |

Section 2.02 |

Excluded Assets |

7 |

Section 2.03 |

Assumed Liabilities |

7 |

Section 2.04 |

Excluded Liabilities |

8 |

Section 2.05 |

Purchase Price |

9 |

Section 2.06 |

Purchase Price Adjustment |

10 |

Section 2.07 |

Allocation of Purchase Price |

10 |

Section 2.08 |

Withholding Tax |

11 |

Section 2.09 |

Third Party Consents |

11 |

ARTICLE III CLOSING |

11 |

|

Section 3.01 |

Closing |

11 |

Section 3.02 |

Closing Deliverables |

11 |

ARTICLE IV REPRESENTATIONS AND WARRANTIES OF SELLER |

13 |

|

Section 4.01 |

Organization and Qualification of Seller |

13 |

Section 4.02 |

Authority of Seller |

13 |

Section 4.03 |

No Conflicts; Consents |

14 |

Section 4.04 |

Absence of Certain Changes, Events and Conditions |

14 |

Section 4.05 |

Material Contracts |

14 |

Section 4.06 |

Title to Purchased Assets |

15 |

Section 4.07 |

Condition of Assets |

16 |

Section 4.08 |

Insurance |

16 |

Section 4.09 |

Legal Proceedings; Governmental Orders |

16 |

Section 4.10 |

Compliance With Laws; Permits |

17 |

Section 4.11 |

Environmental Matters |

17 |

Section 4.12 |

Taxes |

17 |

Section 4.13 |

Brokers |

18 |

Section 4.14 |

No Other Representations and Warranties |

18 |

ARTICLE V REPRESENTATIONS AND WARRANTIES OF BUYER |

18 |

|

Section 5.01 |

Organization of Buyer |

19 |

i

Section 5.02 |

Authority of Buyer |

19 |

Section 5.03 |

No Conflicts; Consents |

19 |

Section 5.04 |

Brokers |

19 |

ARTICLE VI COVENANTS |

19 |

|

Section 6.01 |

Conduct of Business Prior to the Closing |

19 |

Section 6.02 |

Access to Information |

20 |

Section 6.03 |

No Solicitation of Other Bids |

21 |

Section 6.04 |

Notice of Certain Events |

21 |

Section 6.05 |

Confidentiality |

22 |

Section 6.06 |

Governmental Approvals and Consents |

22 |

Section 6.07 |

Closing Conditions |

23 |

Section 6.08 |

Public Announcements |

23 |

Section 6.09 |

Bulk Sales Laws |

23 |

Section 6.10 |

Transfer Taxes |

23 |

Section 6.11 |

Further Assurances |

24 |

ARTICLE VII CONDITIONS TO CLOSING |

24 |

|

Section 7.01 |

Conditions to Obligations of All Parties |

24 |

Section 7.02 |

Conditions to Obligations of Buyer |

24 |

Section 7.03 |

Conditions to Obligations of Seller |

27 |

ARTICLE VIII INDEMNIFICATION |

28 |

|

Section 8.01 |

Survival |

28 |

Section 8.02 |

Indemnification by Seller |

28 |

Section 8.03 |

Indemnification By Buyer |

29 |

Section 8.04 |

Limitations to Indemnification |

29 |

Section 8.05 |

Indemnification Procedures |

29 |

Section 8.06 |

Payments |

31 |

Section 8.07 |

Tax Treatment of Indemnification Payments |

32 |

Section 8.08 |

Effect of Investigation |

32 |

Section 8.09 |

Minimum Net Worth |

32 |

ARTICLE IX TERMINATION |

32 |

|

Section 9.01 |

Termination |

32 |

Section 9.02 |

Effect of Termination |

33 |

ii

ARTICLE X MISCELLANEOUS |

33 |

|

Section 10.01 |

Expenses |

33 |

Section 10.02 |

Notices |

33 |

Section 10.03 |

Interpretation |

34 |

Section 10.04 |

Headings |

35 |

Section 10.05 |

Severability |

35 |

Section 10.06 |

Entire Agreement |

35 |

Section 10.07 |

Successors and Assigns |

35 |

Section 10.08 |

No Third-Party Beneficiaries |

35 |

Section 10.09 |

Amendment and Modification; Waiver |

35 |

Section 10.10 |

Governing Law; Submission to Jurisdiction; Waiver of Jury Trial |

36 |

Section 10.11 |

Specific Performance |

36 |

Section 10.12 |

Counterparts |

36 |

iii

ASSET PURCHASE AGREEMENT

This Asset Purchase Agreement (this “Agreement”), dated as of November 14, 2024 (“Execution Date”), is entered into between Tech Infrastructure JV I LLC, a Delaware limited liability company (“Seller”), and US Digital Mining and Hosting Oklahoma LLC, an Oklahoma limited liability company (“Buyer”).

RECITALS

WHEREAS, Seller holds certain assets that it uses in the business of owning and operating a Bitcoin mining hosting facility in Calumet, Oklahoma (the “Business”); and

WHEREAS, Seller wishes to sell and assign to Buyer, and Buyer wishes to purchase and assume from Seller, the rights and obligations of Seller to the Purchased Assets and the Assumed Liabilities (as defined herein), subject to the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

DEFINITIONS

The following terms have the meanings specified or referred to in this Article I:

“Acquisition Proposal” is defined in Section 6.03(a).

“Action” means any claim, action, cause of action, demand, lawsuit, arbitration, inquiry, audit, notice of violation, proceeding, litigation, citation, summons, subpoena or investigation of any nature, civil, criminal, administrative, regulatory or otherwise, whether at law or in equity.

“Affiliate” of a Person means any other Person that directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with, such Person. The term “control” (including the terms “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise.

“Agreement” is defined in the preamble.

“Allocation Schedule” is defined in Section 2.07.

“Ancillary Documents” means the Bill of Sale, the Assignment and Assumption Agreement, the Escrow Agreement, the Transition Services Agreement, the Hosting Agreement, and the other agreements, instruments and documents required to be delivered at the Closing.

“Arthur” means Arthur Development Group, Inc., a Delaware corporation, formerly known as Arthur Group Inc., and further formerly known as Arthur Digital Assets, Inc.

DOCPROPERTY DOCXDOCID DMS=NetDocuments Format=<<ID>>.<<VER>> \* MERGEFORMAT 4857-3550-3594.7

DOCPROPERTY DocNumberPrefix 0158841.0795310 DOCPROPERTY DMNumber 4877-2871-6525 DOCPROPERTY DMVersionNumber v15

“Assigned Contracts” is defined in Section 2.01(a).

“Assignment and Assumption Agreement” is defined in Section 3.02(a)2.

“Assumed Liabilities” is defined in Section 2.03.

“Bill of Sale” is defined in Section 3.02(a)1.

“Business” is defined in the recitals.

“Business Day” means any weekday other than a weekday on which commercial banks located in Tampa, Florida are closed for business.

“Buyer” is defined in the preamble.

“Buyer Closing Certificate” is defined in Section 7.03(d).

“Buyer Indemnitees” is defined in Section 8.02.

“Closing” is defined in Section 3.01.

“Closing Date” is defined in Section 3.01.

“Closing Purchase Price” is defined in Section 2.05(b).

“Code” means the Internal Revenue Code of 1986, as amended.

“Containers” means those certain GigaBox Air containers identified on Exhibit A attached hereto.

“Contracts” means all contracts, leases, deeds, mortgages, licenses, instruments, notes, commitments, undertakings, indentures, joint ventures and all other agreements, commitments and legally binding arrangements, whether written or oral.

“Debt” means the obligations of Seller with respect to amounts due pursuant to (i) that certain Amended and Restated Promissory Note date July 16, 2024 by and between Seller and LMFA, and (ii) that certain Promissory Note dated November 14, 2024 by and between LM Funding and Seller.

“Debt Payoff Amount” is defined in Section 2.05(a).

“Direct Claim” is defined in Section 8.05(c).

“Disclosure Schedules” means the Disclosure Schedules delivered by Seller concurrently with the execution and delivery of this Agreement.

“Dollars or $” means the lawful currency of the United States.

2

“Encumbrance” means any charge, claim, community property interest, pledge, condition, equitable interest, lien (statutory or other), option, security interest, mortgage, easement, encroachment, right of way, right of first refusal, or restriction of any kind, including any restriction on use, voting, transfer, receipt of income or exercise of any other attribute of ownership.

“Environmental Claim” means any Action, Governmental Order, lien, fine, penalty, or, as to each, any settlement or judgment arising therefrom, by or from any Person alleging liability of whatever kind or nature (including liability or responsibility for the costs of enforcement proceedings, investigations, cleanup, governmental response, removal or remediation, natural resources damages, property damages, personal injuries, medical monitoring, penalties, contribution, indemnification and injunctive relief) arising out of, based on or resulting from: (a) the presence, Release of, or exposure to, any Hazardous Materials; or (b) any actual or alleged non-compliance with any Environmental Law or term or condition of any Environmental Permit.

“Environmental Law” means any applicable Law, and any Governmental Order or binding agreement with any Governmental Authority: (a) relating to pollution (or the cleanup thereof) or the protection of natural resources, endangered or threatened species, human health or safety, or the environment (including ambient air, soil, surface water or groundwater, or subsurface strata); or (b) concerning the presence of, exposure to, or the management, manufacture, use, containment, storage, recycling, reclamation, reuse, treatment, generation, discharge, transportation, processing, production, disposal or remediation of any Hazardous Materials. The term “Environmental Law” includes, without limitation, the following (including their implementing regulations and any state analogs): the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended by the Superfund Amendments and Reauthorization Act of 1986, 42 U.S.C. §§ 9601 et seq.; the Solid Waste Disposal Act, as amended by the Resource Conservation and Recovery Act of 1976, as amended by the Hazardous and Solid Waste Amendments of 1984, 42 U.S.C. §§ 6901 et seq.; the Federal Water Pollution Control Act of 1972, as amended by the Clean Water Act of 1977, 33 U.S.C. §§ 1251 et seq.; the Toxic Substances Control Act of 1976, as amended, 15 U.S.C. §§ 2601 et seq.; the Emergency Planning and Community Right-to-Know Act of 1986, 42 U.S.C. §§ 11001 et seq.; the Clean Air Act of 1966, as amended by the Clean Air Act Amendments of 1990, 42 U.S.C. §§ 7401 et seq.; and the Occupational Safety and Health Act of 1970, as amended, 29 U.S.C. §§ 651 et seq.

“Environmental Permit” means any Permit, letter, clearance, consent, waiver, closure, exemption, decision or other action required under or issued, granted, given, authorized by or made pursuant to Environmental Law.

“Escrow Agent” means Acquiom Clearinghouse LLC.

“Escrow Agreement” means the Escrow Agreement to be entered into by Buyer, Seller and the Escrow Agent at the Closing.

“Escrow Amount” is defined in Section 2.05(c).

“Estimated Closing Statement” has the meaning set forth in Section 2.06(a)1.

“Estimated Monthly Utilities Amount” has the meaning set forth in Section 2.06(a)1.

3

“Excluded Assets” is defined in Section 2.02.

“Excluded Liabilities” is defined in Section 2.04.

“Execution Date” is defined in the preamble.

“Existing Hosting Agreement” means that certain Hosting Services Agreement dated June 6, 2024, by and between Buyer and Arthur Digital Assets, Inc., a Delaware corporation, as same may be amended and/or supplemented.

“FIRPTA Certificate” is defined in Section 7.02(o).

“Governmental Authority” means any federal, state, local or foreign government or political subdivision thereof, or any agency or instrumentality of such government or political subdivision, or any self-regulated organization or other non-governmental regulatory authority or quasi-governmental authority (to the extent that the rules, regulations or orders of such organization or authority have the force of Law), or any arbitrator, court or tribunal of competent jurisdiction.

“Governmental Order” means any order, writ, judgment, injunction, decree, stipulation, determination or award entered by or with any Governmental Authority.

“Ground Lease” means that certain Ground Lease and Use Agreement for Crypto Mining Facilities dated effective February 16, 2024, by and between Navigator and Arthur.

“Hazardous Materials” means: (a) any material, substance, chemical, waste, product, derivative, compound, mixture, solid, liquid, mineral or gas, in each case, whether naturally occurring or manmade, that is hazardous, acutely hazardous, toxic, or words of similar import or regulatory effect under Environmental Laws; and (b) any petroleum or petroleum-derived products, radon, radioactive materials or wastes, asbestos in any form, lead or lead-containing materials, urea formaldehyde foam insulation and polychlorinated biphenyls.

“Hosting Agreement” is defined in Section 3.02(a)5.

“Indemnified Party” is defined in Section 8.05.

“Indemnifying Party” is defined in Section 8.05.

“Insurance Policies” is defined in Section 4.08.

“Law” means any statute, law, ordinance, regulation, rule, code, order, constitution, treaty, common law, judgment, decree, other requirement or rule of law of any Governmental Authority.

“Lease Amendments” is defined in Section 7.02(n)1.

“Lease Assignment” is defined in Section 7.02(n)1.

“Lease Assignment Election” is defined in Section 7.02(n)1.

4

“Lease Estoppel” is defined in Section 7.02(n)1.

“Lenders” means LMFA and LM Funding.

“Liabilities” means liabilities, obligations or commitments of any nature whatsoever, asserted or unasserted, known or unknown, absolute or contingent, accrued or unaccrued, matured or unmatured or otherwise.

“LMFA” means LMFA Financing, LLC, a Florida limited liability company.

“LM Funding” means LM Funding America, Inc., a Delaware corporation.

“Losses” means losses, damages, liabilities, deficiencies, Actions, judgments, interest, awards, penalties, fines, costs or expenses of whatever kind, including reasonable attorneys’ fees and the cost of enforcing any right to indemnification hereunder and the cost of pursuing any insurance providers; provided, however, that “Losses” shall not include punitive damages, except to the extent actually awarded to a Governmental Authority or other third party.

“Material Adverse Effect” means any event, occurrence, fact, condition or change that is, or could reasonably be expected to become, individually or in the aggregate, materially adverse to (a) the prospects, results of operations, condition (financial or otherwise) or assets of the Business or Seller, (b) the value of the Purchased Assets, or (c) the ability of Seller to consummate the transactions contemplated hereby on a timely basis.

“Material Contracts” is defined in Section 4.05(a).

“MW” means a megawatt of electrical power.

“Navigator” means Navigator SMS Pipeline LLC, a Delaware limited liability company.

“New Ground Lease” shall mean a new ground lease for the Site, in form and substance acceptable to Buyer in Buyer’s sole and absolute discretion, to be executed by Navigator and Buyer if Buyer makes the New Lease Election (as defined herein).

“New Lease Election” is defined in Section 7.02(n)2.

“OG&E” means Oklahoma Gas & Electric.

“Permits” means all permits, licenses, franchises, approvals, authorizations, registrations, certificates, variances and similar rights obtained, or required to be obtained, from Governmental Authorities.

“Permitted Encumbrances” is defined in Section 4.06.

“Person” means an individual, corporation, partnership, joint venture, limited liability company, Governmental Authority, unincorporated organization, trust, association or other entity.

5

“Pre-Closing Tax Period” means any taxable period ending on or before the Closing Date and, with respect to any taxable period beginning before and ending after the Closing Date, the portion of such taxable period ending on and including the Closing Date.

“Purchase Price” is defined in Section 2.05.

“Purchased Assets” is defined in Section 2.01.

“Release” means any actual or threatened release, spilling, leaking, pumping, pouring, emitting, emptying, discharging, injecting, escaping, leaching, dumping, abandonment, disposing or allowing to escape or migrate into or through the environment (including, without limitation, ambient air (indoor or outdoor), surface water, groundwater, land surface or subsurface strata or within any building, structure, facility or fixture).

“Representative” means, with respect to any Person, any and all directors, officers, managers, members, partners, employees, consultants, financial advisors, counsel, accountants and other agents of such Person.

“Seller” is defined in the preamble.

“Seller Closing Certificate” is defined in Section 7.02(h).

“Seller Indemnitees” is defined in Section 8.03.

“Seller’s Knowledge” means the actual knowledge of Rudá Pellini and Cleverton Ribeiro, in each case after due inquiry and investigation.

“Site” means the real property located at 18355 Hwy. 270, Calumet, Oklahoma 73014, which is more particularly described in the Ground Lease at which location Seller owns and operates the Business.

“Tangible Personal Property” is defined in Section 2.01(b).

“Taxes” means all federal, state, local, foreign and other income, gross receipts, sales, use, production, ad valorem, transfer, documentary, franchise, registration, profits, license, lease, service, service use, withholding, payroll, employment, unemployment, estimated, excise, severance, environmental, stamp, occupation, premium, property (real or personal), real property gains, windfall profits, customs, duties or other taxes, fees, assessments or charges of any kind whatsoever, together with any interest, additions or penalties with respect thereto and any interest in respect of such additions or penalties.

“Tax Return” means any return, declaration, report, claim for refund, information return or statement or other document relating to Taxes, including any schedule or attachment thereto, and including any amendment thereof.

“Third Party Claim” is defined in Section 8.05(a).

“Transition Services Agreement” is defined in Section 3.02(a)4.

6

ARTICLE II

PURCHASE AND SALE

Section 2.01 Purchase and Sale of Assets. Subject to the terms and conditions set forth herein, at the Closing, Seller shall sell, assign, transfer, convey and deliver to Buyer, and Buyer shall purchase from Seller, free and clear of any Encumbrances other than Permitted Encumbrances, all of Seller’s right, title and interest in, to and under the assets set forth below (the “Purchased Assets”), which relate to, or are used or held for use in connection with, the Business:

(a) all Contracts set forth on Section 2.01(a) of the Disclosure Schedules (the “Assigned Contracts”);

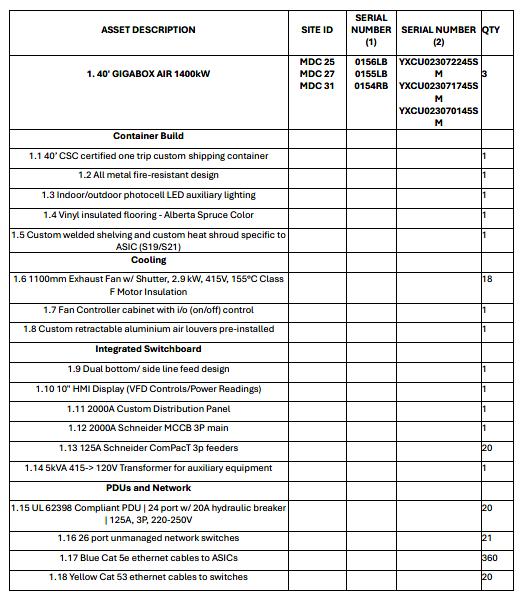

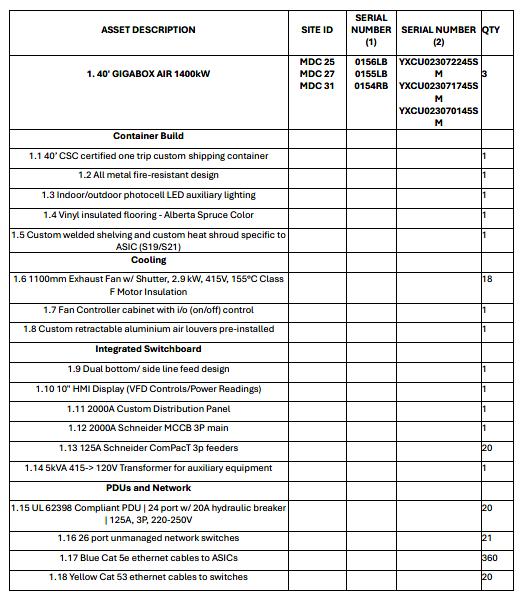

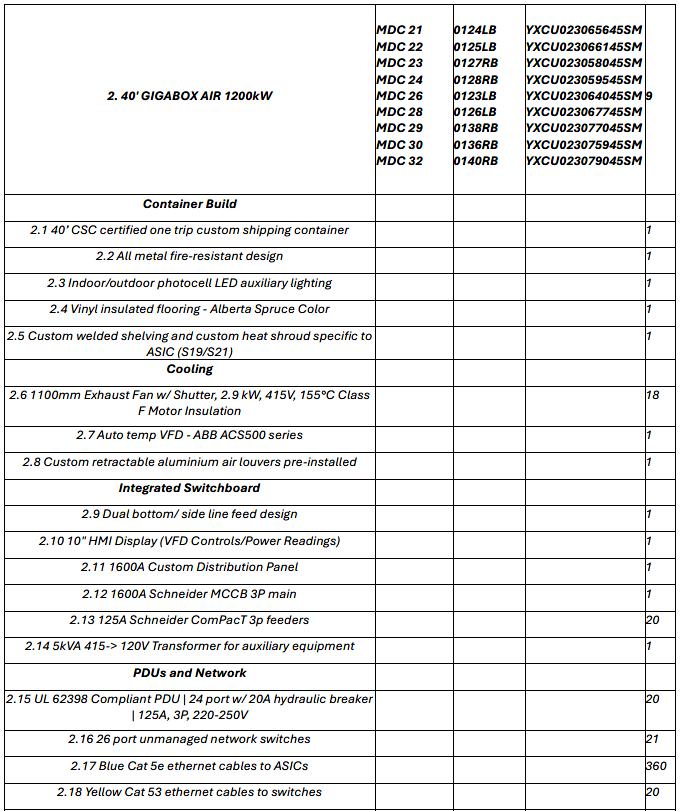

(b) all equipment, tools, and other tangible personal property listed on Exhibit A attached hereto (the “Tangible Personal Property”);

(c) to the extent not specified on Exhibit A, the equipment, tools, and other tangible personal property that existed at the Site as of September 1, 2024 which relate to, or are used or held for use in connection with the Business and the Tangible Personal Property;

(d) all rights to any Actions of any nature available to or being pursued by Seller or its Affiliates to the extent related to the Purchased Assets or the Assumed Liabilities, whether arising by way of counterclaim or otherwise; and

(e) all of Seller’s rights under warranties, indemnities and all similar rights against third parties to the extent related to any Purchased Assets.

Notwithstanding anything herein to the contrary, the Purchased Assets are being acquired by Buyer for its internal purposes and not for purposes of operations of the Business.

Section 2.02 Excluded Assets. The Purchased Assets shall not include any other assets of Seller that are not specified in Section 2.01 above (the “Excluded Assets”).

Section 2.03 Assumed Liabilities. Subject to the terms and conditions set forth herein, Buyer shall assume and agree to pay, perform and discharge only the following Liabilities of Seller (collectively, the “Assumed Liabilities”), and no other Liabilities:

(a) all Liabilities in respect of the Purchased Assets but only to the extent that such Liabilities thereunder are required to be performed after the Closing Date, were incurred in the ordinary course of business and do not relate to any failure to perform, improper performance, breach of warranty or other breach, default or violation prior to the Closing; and

(b) subject to Section 2.04(b) of this Agreement, all liabilities and obligations for Taxes relating to the Purchased Assets, or the Assumed Liabilities for any taxable period ending after the Closing Date.

7

Section 2.04 Excluded Liabilities. Notwithstanding the provisions of Section 2.03 or any other provision in this Agreement to the contrary, Buyer shall not assume and shall not be responsible to pay, perform or discharge any Liabilities of Seller or any of its Affiliates of any kind or nature whatsoever other than the Assumed Liabilities (the “Excluded Liabilities”). Seller shall, and shall cause each of its Affiliates to, pay and satisfy in due course all Excluded Liabilities which they are obligated to pay and satisfy. Without limiting the generality of the foregoing, the Excluded Liabilities shall include, but not be limited to, the following:

(a) any Liabilities of Seller or its Affiliates arising or incurred in connection with the negotiation, preparation, investigation and performance of this Agreement, the Ancillary Documents and the transactions contemplated hereby and thereby, including, without limitation, fees and expenses of counsel, accountants, consultants, advisers and others;

(b) any Liability for (i) Taxes of Seller or its Affiliates relating to the Business, the Purchased Assets or the Assumed Liabilities for any Pre-Closing Tax Period; or (ii) other Taxes of Seller or any of its Affiliates of any kind or description (including any Liability for Taxes of Seller or any of its Affiliates that become a Liability of Buyer under any common law doctrine of de facto merger or transferee or successor liability or otherwise by operation of contract or Law);

(c) any Liabilities relating to or arising out of the Excluded Assets;

(d) any Liabilities in respect of any pending or threatened Action arising out of, relating to or otherwise in respect of the operation of the Business or the Purchased Assets to the extent such Action relates to such operation on or prior to the Closing Date;

(e) any product Liability or similar claim for injury to a Person or property which arises out of or is based upon any express or implied representation, warranty, agreement or guaranty made by Seller or its Affiliates, or by reason of the improper performance or malfunctioning of a product, improper design or manufacture, failure to adequately package, label or warn of hazards or other related product defects of any products at any time manufactured or sold or any service performed by Seller;

(f) any Liabilities of Seller arising under or in connection with any benefit plan providing benefits to any present or former employee of Seller;

(g) any Liabilities of Seller for any present or former employees, officers, directors, retirees, independent contractors or consultants of Seller, or any of its Affiliates, including, without limitation, any Liabilities associated with any claims for wages or other benefits, bonuses, accrued vacation, workers’ compensation, severance, retention, termination or other payments;

(h) any Environmental Claims, or Liabilities under Environmental Laws, to the extent arising out of or relating to facts, circumstances or conditions existing on or prior to the Closing or otherwise to the extent arising out of any actions or omissions of Seller or any of its Affiliates;

8

(i) any trade accounts payable of Seller (i) to the extent not accounted for on Seller’s financial statements; (ii) which constitute intercompany payables owing to Affiliates or equity owners of Seller; (iii) which constitute debt, loans or credit facilities to financial institutions; or (iv) which did not arise in the ordinary course of business;

(j) any Liabilities of the Business relating or arising from unfulfilled commitments, quotations, purchase orders, customer orders or work orders;

(k) any Liabilities to indemnify, defend, reimburse or advance amounts to any present or former officer, director, manager, member, partner, stockholder, employee or agent of Seller (including with respect to any breach of fiduciary obligations by same);

(l) any Liabilities under any Contracts (i) which are not validly and effectively assigned to Buyer pursuant to this Agreement; (ii) which do not conform to the representations and warranties with respect thereto contained in this Agreement; or (iii) to the extent such Liabilities arise out of or relate to a breach by Seller or its Affiliates of such Contracts prior to Closing;

(m) any Liabilities associated with debt, loans or credit facilities of Seller and/or the Business owing to financial institutions; and

(n) any Liabilities arising out of, in respect of or in connection with the failure by Seller or any of its Affiliates to comply with any Law or Governmental Order.

Section 2.05 Purchase Price. The aggregate purchase price for the Purchased Assets shall be $7,300,000, subject to adjustment pursuant to Section 2.06 hereof (the “Purchase Price”), which shall be paid at Closing by wire transfer of immediately available funds as follows:

(a) Buyer shall pay to Lenders the amounts owed by Seller to each of them under the Debt as of the Closing Date (the “Debt Payoff Amount”);

(b) Buyer shall pay to Seller $4,800,000 minus the Debt Payoff Amount (the “Closing Purchase Price”); and

(c) Buyer shall deposit $2,500,000 (the “Escrow Amount”) into escrow with the Escrow Agent, to be held for the purpose of securing Seller’s indemnification obligations set forth herein and Seller’s obligations in both the Transition Services Agreement and the Hosting Agreement. $2,000,000 of the Escrow Amount shall be released to Seller immediately after Seller vacates the Site by removing all of the miners that Seller hosts for its clients, and the remaining $500,000 of the Escrow Amount shall be released to Seller fifteen (15) days after Seller vacates the Site. Seller’s vacation from the Site is the sole condition for the release of the Escrow Amount to Seller, and Seller shall not be required to perform any other obligations to receive the Escrow Amount. Notwithstanding anything herein to the contrary, prior to any release of the Escrow Amount to Seller, amounts due and not separately paid by Seller as of the date of the release in connection with Seller’s indemnification obligations set forth herein and Seller’s obligations in both the Transition Services Agreement and Hosting Agreement shall be paid from the Escrow Amount in accordance with the terms of the Escrow Agreement.

9

Section 2.06 Purchase Price Adjustment.

(a) At or before the Closing, Seller shall deliver to Buyer the following document duly executed or otherwise in proper form:

1. Estimated Closing Statement. Not less than five (5) days prior to the Closing, a statement signed by an authorized officer of Seller (the “Estimated Closing Statement”) setting forth Seller’s good faith calculation of the prorated amount of the monthly utilities incurred, but not paid by Seller prior to Closing, and attributable to the Business, which will be paid by Buyer after Closing (the “Estimated Monthly Utilities Amount”). The Estimated Monthly Utilities Amount shall reduce the Purchase Price payable at the Closing. Seller shall provide Buyer and its Representatives the work papers and other books and records used in preparing the Estimated Closing Statement and reasonable access to appropriate personnel of Seller as Buyer may reasonably request in connection with its review of such Estimated Closing Statement, and Seller will otherwise cooperate reasonably and in good faith with Buyer’s and its Representatives’ review of such Estimated Closing Statement, and shall take into consideration in good faith any reasonable comments of Buyer on the Estimated Closing Statement and the components thereof.

2. Post-Closing Adjustment. Promptly after its receipt of the monthly utility bill after Closing, Buyer shall deliver a copy of the utility bill to Seller. The post-closing adjustment shall be an amount equal to the prorated amount of the actual monthly utilities reflected in the utility bill minus the Estimated Monthly Utilities Amount. If the post-closing adjustment is a positive number, Seller shall pay to Buyer an amount equal to the post-closing adjustment. If the post-closing adjustment is a negative number, Buyer shall pay to Seller an amount equal to the post-closing adjustment.

Section 2.07 Allocation of Purchase Price. Seller and Buyer agree that the Purchase Price (plus other relevant items) shall be allocated among the Purchased Assets for all purposes (including Tax and financial accounting) in accordance with the allocation schedule set forth on Schedule 2.07 (the “Allocation Schedule”). The Allocation Schedule shall be prepared in accordance with Section 1060 of the Internal Revenue Code of 1986, as amended. Buyer and Seller shall file all Tax Returns (including amended returns and claims for refund) and information reports in a manner consistent with the Allocation Schedule. Any adjustments to the Purchase Price pursuant to Section 2.06 herein shall be allocated in a manner consistent with the Allocation Schedule.

Section 2.08 Withholding Tax. Buyer shall be entitled to deduct and withhold from the Purchase Price all Taxes that Buyer may be required to deduct and withhold under any provision of Tax Law. Assuming that Seller delivers a completed and executed IRS Form W-9, Buyer acknowledges that no Tax withholding is required as of the date hereof. In the event Seller does not provide Buyer with an IRS Form W-9, Buyer shall provide Seller with written notice of its intent to withhold at least five (5) days prior to the Closing with a written explanation substantiating the requirement to deduct or withhold, and the parties shall use commercially

10

reasonable efforts to cooperate to mitigate or eliminate any such withholding to the maximum extent permitted by Law. All such withheld amounts shall be treated as delivered to Seller hereunder.

Section 2.09 Third Party Consents. To the extent that Seller’s rights under any Contract or Permit constituting a Purchased Asset, or any other Purchased Asset, may not be assigned to Buyer without the consent of another Person which has not been obtained, this Agreement shall not constitute an agreement to assign the same if an attempted assignment would constitute a breach thereof or be unlawful, and Seller, at its expense, shall use its best efforts to obtain any such required consent(s) as promptly as possible. If any such consent shall not be obtained or if any attempted assignment would be ineffective or would impair Buyer’s rights under the Purchased Asset in question so that Buyer would not in effect acquire the benefit of all such rights, Seller, to the maximum extent permitted by law and the Purchased Asset, shall act after the Closing as Buyer’s agent in order to obtain for it the benefits thereunder and shall cooperate, to the maximum extent permitted by Law and the Purchased Asset, with Buyer in any other reasonable arrangement designed to provide such benefits to Buyer. Notwithstanding any provision in this Section 2.09 to the contrary, Buyer shall not be deemed to have waived its rights under Section 7.02(d) hereof unless and until Buyer either provides written waivers thereof or elects to proceed to consummate the transactions contemplated by this Agreement at Closing.

ARTICLE III

CLOSING

Section 3.01 Closing. Subject to the terms and conditions of this Agreement, the consummation of the transactions contemplated by this Agreement (the “Closing”) shall take place remotely by exchange of documents and signatures (or their electronic counterparts) within five (5) days from the date that all conditions set forth in Article VII are either satisfied or waived (other than conditions which, by their nature, are to be satisfied on the Closing Date), or at such other time, date or place as the parties mutually agree upon in writing. The date on which the Closing occurs is herein referred to as the “Closing Date”.

Section 3.02 Closing Deliverables.

(a) At the Closing, Seller shall deliver or cause to be delivered to Buyer the following:

1. a bill of sale in form and substance satisfactory to Buyer (the “Bill of Sale”) and duly executed by Seller, transferring the tangible personal property included in the Purchased Assets to Buyer;

2. an assignment and assumption agreement in form and substance satisfactory to Buyer (the “Assignment and Assumption Agreement”) and duly executed by Seller, effecting the assignment to and assumption by Buyer of the Purchased Assets and the Assumed Liabilities;

3. the Escrow Agreement duly executed by Seller;

11

4. the Transition Services Agreement in form and substance satisfactory to the parties (the “Transition Services Agreement”) duly executed by Arthur, Seller, and Buyer;

5. the Hosting Agreement in form and substance satisfactory to the parties (the “Hosting Agreement”) duly executed by Arthur, Seller, and Buyer;

6. the Seller Closing Certificate;

7. the FIRPTA Certificate;

8. the certificates of the manager or officer of Seller required by Section 7.02(i) and Section 7.02(j);

9. Termination of the Existing Hosting Agreement duly executed by Arthur;

10. If Buyer makes the Lease Assignment Election, the Lease Assignment, the Lease Estoppel, and the Lease Amendments;

11. such other customary instruments of transfer, assumption, filings or documents, in form and substance reasonably satisfactory to Buyer, as may be required to give effect to this Agreement.

(b) At the Closing, Buyer shall deliver to Seller the following:

1. the Closing Purchase Price;

2. the Assignment and Assumption Agreement duly executed by Buyer;

3. the Escrow Agreement duly executed by Buyer;

4. the Transition Services Agreement duly executed by Buyer;

5. the Hosting Agreement duly executed by Buyer;

6. the Buyer Closing Certificate;

7. the certificates of the manager or officer of Buyer required by Section 7.03(e) and Section 7.03(f);

8. Termination of the Existing Hosting Agreement duly executed by Buyer;

9. If Buyer makes the New Lease Election, the New Ground Lease duly executed by Buyer and Navigator;

12

10. If Buyer makes the Lease Assignment Election, the Lease Assignment duly executed by Buyer; and

11. such other customary instruments of transfer, assumption, filings or documents, in form and substance reasonably satisfactory to Seller, as may be required to give effect to this Agreement.

(c) At the Closing, Buyer shall deliver: (i) the Debt Payoff Amount to Lenders; and (ii) the Escrow Amount to the Escrow Agent.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF SELLER

Except as set forth in the correspondingly numbered Section of the Disclosure Schedules, Seller represents and warrants to Buyer that the statements contained in this Article IV are true and correct as of the Execution Date and shall be true and correct as of the Closing Date as though repeated at Closing.

Section 4.01 Organization and Qualification of Seller. Seller is a limited liability company duly organized, validly existing and in good standing under the Laws of the State of Delaware and has full limited liability company power and authority to own, operate or lease the properties and assets now owned, operated or leased by it and to carry on the Business as currently conducted. Seller is duly licensed or qualified to do business and is in good standing in each jurisdiction in which the ownership of the Purchased Assets or the operation of the Business as currently conducted makes such licensing or qualification necessary.

Section 4.02 Authority of Seller. Seller has full limited liability company power and authority to enter into this Agreement and the Ancillary Documents to which Seller is a party, to carry out its obligations hereunder and thereunder and to consummate the transactions contemplated hereby and thereby. The execution and delivery by Seller of this Agreement and any Ancillary Document to which Seller is a party, the performance by Seller of its obligations hereunder and thereunder and the consummation by Seller of the transactions contemplated hereby and thereby have been duly authorized by all requisite corporate action on the part of Seller. This Agreement has been duly executed and delivered by Seller, and (assuming due authorization, execution and delivery by Buyer) this Agreement constitutes a legal, valid and binding obligation of Seller enforceable against Seller in accordance with its terms. When each Ancillary Document to which Seller is or will be a party has been duly executed and delivered by Seller (assuming due authorization, execution and delivery by each other party thereto), such Ancillary Document will constitute a legal and binding obligation of Seller enforceable against it in accordance with its terms.

Section 4.03 No Conflicts; Consents. The execution, delivery and performance by Seller of this Agreement and the Ancillary Documents to which it is a party, and the consummation of the transactions contemplated hereby and thereby, do not and will not: (a) conflict with or result in a violation or breach of, or default under, any provision of the certificate of formation, company agreement or other organizational documents of Seller; (b) conflict with or result in a violation or breach of any provision of any Law or Governmental Order applicable to Seller, the Business or

13

the Purchased Assets; (c) except as set forth in Section 4.03(c) of the Disclosure Schedules, require the consent, notice or other action by any Person under, conflict with, result in a violation or breach of, constitute a default or an event that, with or without notice or lapse of time or both, would constitute a default under, result in the acceleration of or create in any party the right to accelerate, terminate, modify or cancel any Contract or Permit to which Seller is a party or by which Seller or the Business is bound or to which any of the Purchased Assets are subject (including any Assigned Contract); or (d) result in the creation or imposition of any Encumbrance other than Permitted Encumbrances on the Purchased Assets. No consent, approval, Permit, Governmental Order, declaration or filing with, or notice to, any Governmental Authority is required by or with respect to Seller in connection with the execution and delivery of this Agreement or any of the Ancillary Documents and the consummation of the transactions contemplated hereby and thereby.

Section 4.04 Absence of Certain Changes, Events and Conditions. Since July 1, 2024, Seller has not caused the imposition of any Encumbrance (other than Permitted Encumbrances) upon any of the Purchased Assets, and Seller has operated the Business in the ordinary course of business in all material respects and there has not been any change, event, condition or development that is materially adverse to: (a) the business, results of operations, financial condition or assets of the Business, taken as a whole; or (b) the ability of Seller to consummate the transactions contemplated hereby.

Section 4.05 Material Contracts.

(a) Section 4.05(a) of the Disclosure Schedules lists (and is subdivided in accordance with the subdivisions of this Section 4.05(a)) each of the following Contracts (x) by which any of the Purchased Assets are bound or affected or (y) to which Seller is a party or by which it is bound in connection with the Business or the Purchased Assets (such Contracts, together with all Contracts concerning the occupancy, management or operation of any real property utilized in the Business (including without limitation, brokerage contracts) being “Material Contracts”):

1. all Contracts involving aggregate consideration in excess of $50,000 and which, in each case, cannot be cancelled without penalty or without more than 30 days’ notice;

2. all Contracts that require Seller to purchase or sell a stated portion of the requirements or outputs of the Business or that contain “take or pay” provisions;

3. all Contracts that provide for the indemnification of any Person or the assumption of any Tax, environmental or other Liability of any Person;

4. each written warranty, guaranty and/or other similar undertaking with respect to contractual performance extended by Seller other than in the ordinary course of business;

5. all Contracts that relate to the acquisition or disposition of any business, a material amount of stock or assets of any other Person or any real property (whether by merger, sale of stock, sale of assets or otherwise);

14

6. all broker, distributor, dealer, manufacturer’s representative, franchise, agency, sales promotion, market research, marketing consulting and advertising Contracts;

7. all employment agreements and Contracts with independent contractors or consultants (or similar arrangements) and which are not cancellable without material penalty or without more than 30 days’ notice;

8. except for Contracts relating to trade receivables, all Contracts relating to indebtedness (including, without limitation, guarantees);

9. all Contracts with any Governmental Authority;

10. all Contracts that limit or purport to limit compete in any line of business or with any Person or in any geographic area or during any period of time;

11. all joint venture, partnership or similar Contracts;

12. all Contracts for the sale of any of the Purchased Assets or for the grant to any Person of any option, right of first refusal or preferential or similar right to purchase any of the Purchased Assets;

13. all powers of attorney with respect to the Business or any Purchased Asset;

14. all master services agreements under which Seller receives services in connection with the Purchased Assets or the operation of the Business; and

15. all other Contracts that are material to the Purchased Assets or the operation of the Business and not previously disclosed pursuant to this Section 4.05.

(b) Each Material Contract is valid and binding on Seller in accordance with its terms and is in full force and effect. Neither Seller nor its Affiliates are in breach of or default under (or is alleged to be in breach of or default under), except for such breaches or defaults that would not have a Material Adverse Effect. There are no disputes pending or threatened in writing under any Assigned Contracts.

Section 4.06 Title to Purchased Assets. Seller has good and valid title to, or a valid leasehold interest in, all of the Purchased Assets. All such Purchased Assets (including leasehold interests, if any) are free and clear of Encumbrances except for the following (collectively referred to as “Permitted Encumbrances”):

(a) those items set forth in Section 4.06 of the Disclosure Schedules; and

(b) liens for Taxes not yet due and payable.

Section 4.07 Condition of Assets. The buildings, plants, structures, furniture, fixtures, machinery, equipment, and other items of tangible personal property included in the Purchased

15

Assets are structurally sound, are in good operating condition and repair, and are adequate for the uses to which they are being put, and none of such buildings, plants, structures, furniture, fixtures, machinery, equipment, and other items of tangible personal property is in need of maintenance or repairs except for ordinary, routine maintenance and repairs that are not material in nature or cost. Seller has performed reasonable and prudent maintenance on all machinery, equipment, and other items of tangible personal property included in the Purchased Assets on a regular and reasonable basis.

Section 4.08 Insurance. Section 4.08 of the Disclosure Schedules sets forth (a) a true and complete list of all current policies or binders of fire, liability, builders’ risk, professional liability, environmental liability, product liability, umbrella liability, real and personal property, workers’ compensation, vehicular, fiduciary liability and other casualty and property insurance maintained by Seller or its Affiliates and relating to the Business, the Purchased Assets or the Assumed Liabilities (collectively, the “Insurance Policies”); and (b) with respect to the Business, the Purchased Assets or the Assumed Liabilities, a list of all pending claims and the claims history for Seller. There are no claims related to the Business, the Purchased Assets or the Assumed Liabilities pending under any such Insurance Policies as to which coverage has been questioned, denied or disputed or in respect of which there is an outstanding reservation of rights. Seller has given notice to the applicable insurer of all claims arising that might have been insured under any Insurance Policy. Neither Seller nor any of its Affiliates has received any written notice of cancellation of, premium increase with respect to, or alteration of coverage under, any of such Insurance Policies. All premiums due on such Insurance Policies have either been paid or, if not yet due, accrued. All such Insurance Policies (a) are in full force and effect and enforceable in accordance with their terms; (b) are provided by carriers who are financially solvent; and (c) have not been subject to any lapse in coverage. None of Seller or any of its Affiliates is in default under, or has otherwise failed to comply with, in any material respect, any provision contained in any such Insurance Policy. The Insurance Policies are of the type and in the amounts customarily carried by Persons conducting a business similar to the Business and are sufficient for compliance with all applicable Laws and Contracts to which Seller is a party or by which it is bound.

Section 4.09 Legal Proceedings; Governmental Orders.

(a) There are no Actions pending or, to Seller’s Knowledge, threatened against or by Seller (i) relating to or affecting the Business, the Purchased Assets or the Assumed Liabilities; or (ii) that challenge or seek to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement. To Seller’s Knowledge, no event has occurred or circumstances exist that may give rise to, or serve as a basis for, any such Action.

(b) There are no outstanding Governmental Orders and no unsatisfied judgments, penalties or awards against, relating to or affecting the Business.

Section 4.10 Compliance With Laws; Permits.

(a) To Seller’s Knowledge, Seller has complied, and is now complying, with all Laws applicable to the conduct of the Business as currently conducted or the ownership and use of the Purchased Assets, except where the failure to be in compliance would not have a Material Adverse Effect.

16

(b) All Permits required for Seller to conduct the Business as currently conducted or for the ownership and use of the Purchased Assets have been obtained by Seller and are valid and in full force and effect, except where the failure to obtain such Permits would not have a Material Adverse Effect. All fees and charges with respect to such Permits have been paid in full. Section 4.10(b) of the Disclosure Schedules lists all current Permits issued to Seller which are related to the conduct of the Business as currently conducted or the ownership and use of the Purchased Assets, including the names of the Permits and their respective dates of issuance and expiration. To Seller’s Knowledge, no event has occurred that, with or without notice or lapse of time or both, would reasonably be expected to result in the revocation, suspension, lapse or limitation of any Permit set forth in Section 4.10(b) of the Disclosure Schedules.

Section 4.11 Environmental Matters. To Seller’s Knowledge, the operations of Seller and its Affiliates with respect to the Business and the Purchased Assets are currently and have been in compliance with all Environmental Laws. Neither Seller nor its Affiliates have received from any Person, with respect to the Business, the Site, or the Purchased Assets, any notice related to any breach of any Environmental Laws, which, in each case, either remains pending or unresolved, or is the source of ongoing obligations or requirements as of the Closing Date. To Seller’s knowledge there has been no Release of Hazardous Materials in contravention of Environmental Law with respect to the Business or the Purchased Assets or any real property currently or formerly owned, leased or operated by Seller or its Affiliates in connection with the Business.

Section 4.12 Taxes.

(a) All Tax Returns required to be filed by Seller for any Pre-Closing Tax Period have been, or will be, timely filed. Such Tax Returns are, or will be, true, complete and correct in all respects. All Taxes due and owing by Seller (whether or not shown on any Tax Return) have been, or will be, timely paid.

(b) Seller has withheld and timely paid each Tax required to have been withheld and paid in connection with amounts paid or owing to any employee, independent contractor, creditor, customer, shareholder or other party, and complied with all information reporting and backup withholding provisions of applicable Law.

(c) No extensions or waivers of statutes of limitations have been given or requested with respect to any Taxes of Seller. Seller currently is not the beneficiary of any extension of time within which to file any Tax Return.

(d) No claim has ever been made or is expected to be made by any Governmental Authority in a jurisdiction where Seller does not file Tax Returns that it is or may be subject to taxation by that jurisdiction.

(e) All deficiencies asserted, or assessments made, against Seller as a result of any examinations by any taxing authority have been fully paid.

(f) Seller is not a party to any Action by any taxing authority, and there are no pending or, to Seller’s Knowledge, threatened Actions by any taxing authority.

17

(g) There are no Encumbrances for Taxes upon any of the Purchased Assets nor is any taxing authority in the process of imposing any Encumbrances for Taxes on any of the Purchased Assets (other than for current Taxes not yet due and payable).

(h) Seller is not a “foreign person” as that term is used in Treasury Regulations Section 1.1445-2.

(i) None of the Purchased Assets is (i) required to be treated as being owned by another person pursuant to the so-called “safe harbor lease” provisions of former Section 168(f)(8) of the Internal Revenue Code of 1954, as amended, (ii) subject to Section 168(g)(1)(A) of the Code, or (iii) subject to a disqualified leaseback or long-term agreement as defined in Section 467 of the Code.

(j) None of the Purchased Assets is tax-exempt use property within the meaning of Section 168(h) of the Code.

Section 4.13 Brokers. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transactions contemplated by this Agreement or any Ancillary Document based upon arrangements made by or on behalf of Seller.

Section 4.14 No Other Representations and Warranties. Except for the representations and warranties contained in this Article IV (including the related portions of the Disclosure Schedules), or any representations or warranties to be contained in the documents delivered at Closing, Seller has not made, and does not make, any other express or implied representation or warranty regarding the Business or the Purchased Assets.

ARTICLE V

REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer represents and warrants to Seller that the statements contained in this ARTICLE V are true and correct.

Section 5.01 Organization of Buyer. Buyer is a limited liability company duly organized, validly existing and in good standing under the Laws of the State of Oklahoma.

Section 5.02 Authority of Buyer. Buyer has full limited liability company power and authority to enter into this Agreement and the Ancillary Documents to which Buyer is a party, to carry out its obligations hereunder and thereunder and to consummate the transactions contemplated hereby and thereby. The execution and delivery by Buyer of this Agreement and any Ancillary Document to which Buyer is a party, the performance by Buyer of its obligations hereunder and thereunder and the consummation by Buyer of the transactions contemplated hereby and thereby have been duly authorized by all requisite limited liability company action on the part of Buyer. This Agreement has been duly executed and delivered by Buyer, and (assuming due authorization, execution and delivery by Seller) this Agreement constitutes a legal, valid and binding obligation of Buyer enforceable against Buyer in accordance with its terms. When each Ancillary Document to which Buyer is or will be a party has been duly executed and delivered by Buyer (assuming due authorization, execution and delivery by each other party thereto), such

18

Ancillary Document will constitute a legal and binding obligation of Buyer enforceable against it in accordance with its terms.

Section 5.03 No Conflicts; Consents. The execution, delivery and performance by Buyer of this Agreement and the Ancillary Documents to which it is a party, and the consummation of the transactions contemplated hereby and thereby, do not and will not: (a) conflict with or result in a violation or breach of, or default under, any provision of the certificate of formation, operating agreement or other organizational documents of Buyer; (b) conflict with or result in a violation or breach of any provision of any Law or Governmental Order applicable to Buyer; or (c) require the consent, notice or other action by any Person under any Contract to which Buyer is a party. No consent, approval, Permit, Governmental Order, declaration or filing with, or notice to, any Governmental Authority is required by or with respect to Buyer in connection with the execution and delivery of this Agreement and the Ancillary Documents and the consummation of the transactions contemplated hereby and thereby.

Section 5.04 Brokers. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transactions contemplated by this Agreement or any Ancillary Document based upon arrangements made by or on behalf of Buyer.

ARTICLE VI

COVENANTS

Section 6.01 Conduct of Business Prior to the Closing. From the Execution Date until the Closing, except as otherwise provided in this Agreement or consented to in writing by Buyer (which consent shall not be unreasonably withheld or delayed), Seller shall, and it shall cause each of its Affiliates to, (x) conduct the Business in the ordinary course of business consistent with past practice; and (y) use reasonable best efforts to maintain and preserve intact its current Business organization, operations and franchise and to preserve the rights, franchises, goodwill and relationships of its employees, customers, lenders, suppliers, regulators and others having relationships with the Business. Without limiting the foregoing, from the Execution Date until the Closing Date, Seller shall, and it shall cause each of its Affiliates to:

(a) preserve and maintain all Permits required for the conduct of the Business as currently conducted or the ownership and use of the Purchased Assets;

(b) pay the debts, Taxes and other obligations of the Business when due;

(c) maintain the properties and assets included in the Purchased Assets in the same condition as they were on the Execution Date;

(d) continue in full force and effect without modification all Insurance Policies, except as required by applicable Law;

(e) defend and protect the properties and assets included in the Purchased Assets from infringement or usurpation;

(f) perform all of its obligations under all Assigned Contracts;

19

(g) perform all of its obligations under the Ground Lease;

(h) cooperate in all respects with Buyer’s due diligence and inspections of the Site;

(i) maintain the books and records in accordance with past practice;

(j) comply with all Laws applicable to the conduct of the Business or the ownership and use of the Purchased Assets;

(k) not take or permit any action that would cause any of the changes, events or conditions described in Section 4.04 to occur; and

(l) not take any action, or fail to take any action, that would result in an Encumbrance of any kind to be recorded against the Site, or that would cause a material adverse change to the condition of the Site.

Section 6.02 Access to Information. From the Execution Date until the Closing, Seller shall (a) afford Buyer and its Representatives full and free access to and the right to inspect the Site, properties, assets, premises, books and records, Contracts and other documents and data related to the Business and the Purchased Assets; (b) furnish Buyer and its Representatives with such financial, operating and other data and information related to the Business as Buyer or any of its Representatives may reasonably request; and (c) instruct the Representatives of Seller to cooperate with Buyer in its investigation of the Business; provided, however, that any such investigation shall be conducted during normal business hours upon reasonable advance notice to Seller and in such a manner as not to materially interfere with the conduct of the Business or any other businesses of Seller. Without limiting the foregoing, Seller, Arthur, and any applicable Affiliates shall permit Buyer and its Representatives to conduct environmental due diligence of any real property on which Seller conducts its business, including the collecting and analysis of samples of indoor or outdoor air, surface water, groundwater or surface or subsurface land on, at, in, under or from the applicable surface real property. No investigation by Buyer or other information received by Buyer shall operate as a waiver of or otherwise affect any representation, warranty or agreement given or made by Seller in this Agreement.

Section 6.03 No Solicitation of Other Bids. From the Execution Date until the Closing:

(a) Seller shall not, and shall not authorize or permit any of its Affiliates or any of its or their Representatives to, directly or indirectly, (i) encourage, solicit, initiate, facilitate or continue inquiries regarding an Acquisition Proposal; (ii) enter into discussions or negotiations with, or provide any information to, any Person concerning a possible Acquisition Proposal; or (iii) enter into any agreements or other instruments (whether or not binding) regarding an Acquisition Proposal. Seller shall immediately cease and cause to be terminated and shall cause its Affiliates and all of its and their Representatives to immediately cease and cause to be terminated, all existing discussions or negotiations with any Persons conducted heretofore with respect to, or that could lead to, an Acquisition Proposal. For purposes hereof, “Acquisition Proposal” means any inquiry, proposal or offer from any Person (other than Buyer or any of its Affiliates) relating to the direct or

20

indirect disposition, whether by sale, merger or otherwise, of all or any portion of the Business or the Purchased Assets, including by sale of company interests in Seller.

(b) In addition to the other obligations under this Section 6.03, Seller shall promptly (and in any event within two (2) Business Days after receipt thereof by Seller or its Representatives) advise Buyer orally and in writing of any Acquisition Proposal, any request for information with respect to any Acquisition Proposal, or any inquiry with respect to or which could reasonably be expected to result in an Acquisition Proposal, the material terms and conditions of such request, Acquisition Proposal or inquiry, and the identity of the Person making the same.

(c) Seller agrees that the rights and remedies for noncompliance with this Section 6.03 shall include having such provision specifically enforced by any court having equity jurisdiction, it being acknowledged and agreed that any such breach or threatened breach shall cause irreparable injury to Buyer and that money damages would not provide an adequate remedy to Buyer.

Section 6.04 Notice of Certain Events.

(a) From the Execution Date until the Closing, Seller shall promptly notify Buyer in writing of:

1. any fact, circumstance, event or action the existence, occurrence or taking of which (A) has had, or could reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect, (B) has resulted in, or could reasonably be expected to result in, any representation or warranty made by Seller hereunder not being true and correct or (C) has resulted in, or could reasonably be expected to result in, the failure of any of the conditions set forth in Section 7.02 to be satisfied;

2. any notice or other communication from any Person alleging that the consent of such Person is or may be required in connection with the transactions contemplated by this Agreement;

3. any notice or other communication from any Governmental Authority in connection with the transactions contemplated by this Agreement; and

4. any Actions commenced or, to Seller’s Knowledge, threatened against, relating to or involving or otherwise affecting the Business, the Purchased Assets, or the Assumed Liabilities that, if pending on the Execution Date, would have been required to have been disclosed pursuant to Article IV or that relates to the consummation of the transactions contemplated by this Agreement.

(b) Buyer’s receipt of information pursuant to this Section 6.04 shall not operate as a waiver or otherwise affect any representation, warranty or agreement given or made by Seller in this Agreement (including Section 8.02 and Section 9.01(b)) and shall not be deemed to amend or supplement the Disclosure Schedules.

21

Section 6.05 Confidentiality. Buyer and Seller acknowledge and agree that the Mutual Nondisclosure Agreement, dated as of December 13, 2022, between Buyer and Arthur Digital Assets, Inc. (and its Affiliates including Seller), remains in full force and effect.

Section 6.06 Governmental Approvals and Consents.

(a) Each party shall, as promptly as possible, (i) make, or cause or be made, all filings and submissions required under any Law applicable to such party or any of its Affiliates; and (ii) use reasonable best efforts to obtain, or cause to be obtained, all consents, authorizations, orders and approvals from all Governmental Authorities that may be or become necessary for its execution and delivery of this Agreement and the performance of its obligations pursuant to this Agreement and the Ancillary Documents. Each party shall cooperate fully with the other party and its Affiliates in promptly seeking to obtain all such consents, authorizations, orders and approvals. The parties shall not willfully take any action that will have the effect of delaying, impairing or impeding the receipt of any required consents, authorizations, orders and approvals.

(b) Seller and Buyer shall use their reasonable best efforts to give all notices to, and obtain all consents from, all third parties that are described in Section 4.03 of the Disclosure Schedules.

(c) Without limiting the generality of the parties’ undertakings pursuant to subsections (a) and (b) above, each of the parties hereto shall use all reasonable best efforts to:

1. respond to any inquiries by any Governmental Authority regarding antitrust or other matters with respect to the transactions contemplated by this Agreement or any Ancillary Document;

2. avoid the imposition of any order or the taking of any action that would restrain, alter or enjoin the transactions contemplated by this Agreement or any Ancillary Document; and

3. in the event any Governmental Order adversely affecting the ability of the parties to consummate the transactions contemplated by this Agreement or any Ancillary Document has been issued, to have such Governmental Order vacated or lifted.

Section 6.07 Closing Conditions. From the Execution Date until the Closing, each party shall use reasonable best efforts to take such actions as are necessary to expeditiously satisfy the closing conditions set forth in Article VII hereof.

Section 6.08 Public Announcements. Unless otherwise required by applicable Law (based upon the reasonable advice of counsel), no party to this Agreement shall make any public announcements in respect of this Agreement or the transactions contemplated hereby or otherwise communicate with any news media without the prior written consent of the other party (which consent shall not be unreasonably withheld or delayed), and the parties shall cooperate as to the timing and contents of any such announcement.

22

Section 6.09 Bulk Sales Laws. The parties hereby waive compliance with the provisions of any bulk sales, bulk transfer or similar Laws of any jurisdiction that may otherwise be applicable with respect to the sale of any or all of the Purchased Assets to Buyer; it being understood that any Liabilities arising out of the failure of Seller to comply with the requirements and provisions of any bulk sales, bulk transfer or similar Laws of any jurisdiction which would not otherwise constitute Assumed Liabilities shall be treated as Excluded Liabilities.

Section 6.10 Transfer Taxes. All transfer, documentary, sales, use, stamp, registration, value added and other such Taxes and fees (including any penalties and interest) incurred in connection with this Agreement and the Ancillary Documents (including any real property transfer Tax and any other similar Tax) shall be borne and paid by Buyer when due, provided that Buyer qualifies for a sales tax exemption for the purchase of machinery and equipment used for commercial mining of digital assets in a colocation agreement pursuant to 68 O.S. Section 1359. Buyer shall, at its own expense, timely file any Tax Return or other document with respect to such Taxes or fees (and Seller shall cooperate with respect thereto as necessary). Buyer shall apply for the sales tax exemption within five (5) business days following the Closing Date. Buyer shall promptly notify the Seller in writing within three (3) business days of receiving any notice of approval or denial of the sales tax exemption application from the relevant taxing authority. In the event that the Buyer is not eligible for the sales tax exemption described in Section 6.10, the Seller shall be responsible for the payment of any sales tax required under this Section 6.10.

Section 6.11 Further Assurances. Following the Closing, each party shall, and shall cause their respective Affiliates to, execute and deliver such additional documents, instruments, conveyances and assurances and take such further actions as may be reasonably required to carry out the provisions hereof and give effect to the transactions contemplated by this Agreement and the Ancillary Documents.

ARTICLE VII

CONDITIONS TO CLOSING

Section 7.01 Conditions to Obligations of All Parties. The obligations of each party to consummate the transactions contemplated by this Agreement shall be subject to the fulfillment, at or prior to the Closing, of each of the following conditions:

(a) No Governmental Authority shall have enacted, issued, promulgated, enforced or entered any Governmental Order which is in effect and has the effect of making the transactions contemplated by this Agreement illegal, otherwise restraining or prohibiting consummation of such transactions or causing any of the transactions contemplated hereunder to be rescinded following completion thereof.

(b) Seller shall have received all consents, authorizations, orders and approvals from the Governmental Authorities referred to in Section 4.03 and Buyer shall have received all consents, authorizations, orders and approvals from the Governmental Authorities referred to in Section 5.03, in each case, in form and substance reasonably satisfactory to Buyer, and no such consent, authorization, order and approval shall have been revoked.

23

(c) Buyer and Seller shall have caused the Existing Hosting Agreement to be terminated.

Section 7.02 Conditions to Obligations of Buyer. The obligations of Buyer to consummate the transactions contemplated by this Agreement shall be subject to the fulfillment or Buyer’s waiver, at or prior to the Closing, of each of the following conditions:

(a) Other than the representations and warranties of Seller contained in Section 4.01, Section 4.02, and Section 4.13, the representations and warranties of Seller contained in this Agreement, the Ancillary Documents and any certificate or other writing delivered pursuant hereto shall be true and correct in all respects (in the case of any representation or warranty qualified by materiality or Material Adverse Effect) or in all material respects (in the case of any representation or warranty not qualified by materiality or Material Adverse Effect) on and as of the Execution Date and on and as of the Closing Date with the same effect as though made at and as of such date. The representations and warranties of Seller contained in Section 4.01, Section 4.02, and Section 4.13 shall be true and correct in all respects on and as of the Execution Date and on and as of the Closing Date with the same effect as though made at and as of such date.

(b) Seller shall have duly performed and complied in all material respects with all agreements, covenants and conditions required by this Agreement and each of the Ancillary Documents to be performed or complied with by it prior to or on the Closing Date; provided, that, with respect to agreements, covenants and conditions that are qualified by materiality, Seller shall have performed such agreements, covenants and conditions, as so qualified, in all respects.

(c) No Action shall have been commenced against Buyer or Seller, which would prevent the Closing. No injunction or restraining order shall have been issued by any Governmental Authority, and be in effect, which restrains or prohibits any transaction contemplated hereby.

(d) All approvals, consents and waivers that are listed on Section 4.03 of the Disclosure Schedules shall have been received, and executed counterparts thereof shall have been delivered to Buyer at or prior to the Closing.

(e) From the Execution Date, there shall not have occurred any Material Adverse Effect, nor shall any event or events have occurred that, individually or in the aggregate, with or without the lapse of time, could reasonably be expected to result in a Material Adverse Effect.

(f) Seller shall have delivered to Buyer duly executed counterparts to the Ancillary Documents and such other documents and deliveries set forth in Section 3.02(a).

(g) All Encumbrances relating to the Purchased Assets shall have been released in full, other than Permitted Encumbrances, and Seller shall have delivered to Buyer written evidence, in form satisfactory to Buyer in its sole discretion, of the release of such Encumbrances.

24

(h) Buyer shall have received a certificate, dated the Closing Date and signed by a duly authorized officer of Seller, that each of the conditions set forth in Section 7.02(a) and Section 7.02(b) have been satisfied (the “Seller Closing Certificate”).

(i) Buyer shall have received a certificate of the manager or officer of Seller certifying that attached thereto are true and complete copies of all resolutions adopted by the board of directors of Seller authorizing the execution, delivery and performance of this Agreement and the Ancillary Documents and the consummation of the transactions contemplated hereby and thereby, and that all such resolutions are in full force and effect and are all the resolutions adopted in connection with the transactions contemplated hereby and thereby.

(j) Buyer shall have received a certificate of the manager or officer of Seller certifying the names and signatures of the officers of Seller authorized to sign this Agreement, the Ancillary Documents and the other documents to be delivered hereunder and thereunder.

(k) Buyer shall have contracted with or obtained a “will serve” letter from OG&E for electric service to the Site in quantities sufficient for Buyer’s operations at the Site, in Buyer’s sole and absolute discretion.

(l) Buyer shall have completed its due diligence review of the Site and shall have satisfied itself that the condition of the Site is acceptable in all respects in Buyer’s sole and absolute discretion.

(m) Buyer shall have executed the Hosting Agreement in form and substance reasonably agreeable to Buyer, Seller and Arthur, which shall provide for the following, at a minimum:

1. A termination date not later than December 31, 2024;

2. Arthur shall not be permitted to use more than 5MW of electrical power;

3. Arthur shall reimburse Buyer for all electricity used, including, but not limited to, any electricity used to operate the Containers housing Arthur’s miners;

4. Arthur shall be responsible for all costs, labor and materials for its hosted miners or any miners belonging to Arthur at the Site;

5. Arthur shall, at its sole cost and expense, maintain in good condition and repair, the four (4) Containers used by Arthur, and deliver same to Buyer in good condition prior to the termination date of the Hosting Agreement; and

6. Arthur shall have access to the Satokie repair team at the Site and shall pay a prorated amount of the monthly bill associated with same in proportion to the number of Containers being used.

25

(n) The occurrence of one of the following, at Buyer’s election and in Buyer’s sole and absolute discretion, shall have occurred:

1. (i) Navigator, Buyer, Seller, and Arthur shall have caused the Ground Lease to be assigned to Buyer (the “Lease Assignment Election”) pursuant to an assignment in form and substance acceptable to Buyer and Seller in their reasonable discretion (the “Lease Assignment”), (ii) Navigator, Buyer, Seller, and Arthur shall have executed any amendments to the Ground Lease that Buyer deems necessary for Buyer’s operations at the Site, in Buyer’s sole and absolute discretion (the “Lease Amendments”), including, but not limited to, an amendment to the Ground Lease to include a purchase option in favor of the “Tenant” to purchase the Site, on terms acceptable to Buyer in Buyer’s sole and absolute discretion, and (iii) Navigator and Arthur have provided Buyer with an estoppel certificate in form and substance acceptable to Buyer, but at a minimum (A) confirming the Ground Lease is in full force and effect, (B) stating whether or not the Ground Lease has been amended or modified, and submitting copies of such modifications or amendments, if any, and (C) confirming that no defaults exist thereunder and that no conditions exist that, with the passage of time or giving of notice, could constitute a default thereunder (the “Lease Estoppel”); or

2. Navigator and Buyer shall have executed a New Ground Lease (the “New Lease Election”).

(o) Buyer shall have received a certificate pursuant to Treasury Regulations Section 1.1445-2(b) (the “FIRPTA Certificate”) that Seller is not a foreign person within the meaning of Section 1445 of the Code duly executed by Seller.

(p) Buyer will have obtained the approval of its members and governing board.

(q) Buyer must be satisfied, in its sole discretion, with the results of operational, legal, financial, accounting and environmental due diligence and investigations of the Business performed by its attorneys, accountants and representatives.

Section 7.03 Conditions to Obligations of Seller. The obligations of Seller to consummate the transactions contemplated by this Agreement shall be subject to the fulfillment or Seller’s waiver, at or prior to the Closing, of each of the following conditions: