An emerging leader in Bitcoin mining Q4 2024 Supplemental Investor Presentation Nasdaq: LMFA

This presentation may contain forward-looking statements the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” and “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. Some of these risks and uncertainties are identified in the company's most recent Annual Report on Form 10-K and its other filings with the SEC, which are available at www.sec.gov. These risks and uncertainties include, without limitation, the risks of operating in the cryptocurrency mining business, our limited operating history in the cryptocurrency mining business and our ability to grow that business, the capacity of our Bitcoin mining machines and our related ability to purchase power at reasonable prices, our ability to identify and acquire additional mining sites, the ability to finance our site acquisitions and cryptocurrency mining operations, our ability to acquire new accounts in our specialty finance business at appropriate prices, changes in governmental regulations that affect our ability to collected sufficient amounts on defaulted consumer receivables, changes in the credit or capital markets, changes in interest rates, and negative press regarding the debt collection industry. The occurrence of any of these risks and uncertainties could have a material adverse effect on our business, financial condition, and results of operations. For additional disclosure regarding risks faced by LM Funding America, Inc., please see our public filings with the Securities and Exchange Commission, available on the Investor Relations section of our website at www.lmfunding.com and on the SEC's website at www.sec.gov. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures, such as Core EBITDA. These non-GAAP measures are presented for supplemental information and should not be considered a substitute for financial information presented in accordance with GAAP. A reconciliation of these non-GAAP measures to the most directly comparable GAAP measures is set forth in the Appendix to this presentation Forward-Looking Statements

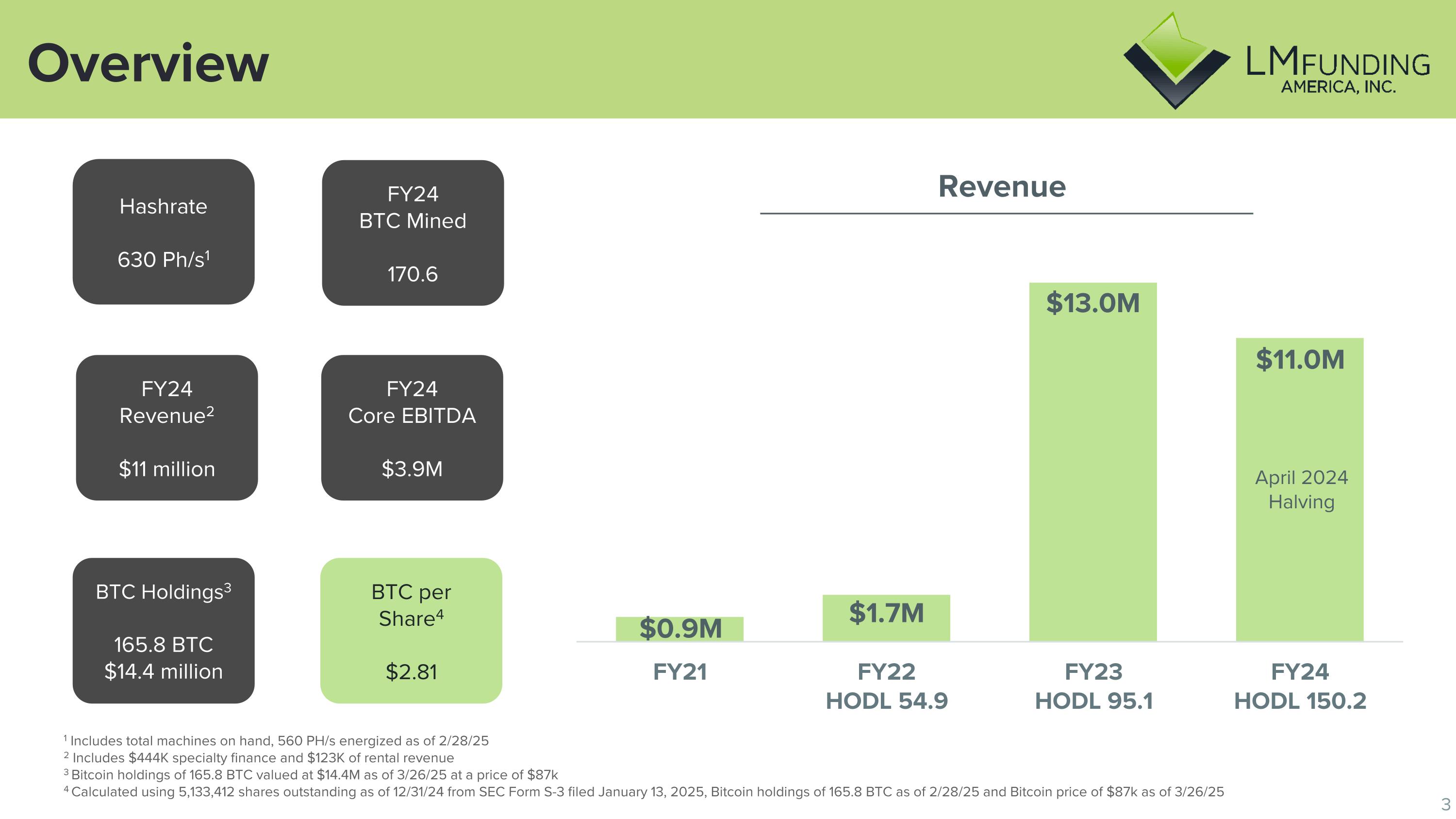

Overview 1 Includes total machines on hand, 560 PH/s energized as of 2/28/25 2 Includes $444K specialty finance and $123K of rental revenue 3 Bitcoin holdings of 165.8 BTC valued at $14.4M as of 3/26/25 at a price of $87k 4 Calculated using 5,133,412 shares outstanding as of 12/31/24 from SEC Form S-3 filed January 13, 2025, Bitcoin holdings of 165.8 BTC as of 2/28/25 and Bitcoin price of $87k as of 3/26/25 Hashrate 630 Ph/s1 FY24 BTC Mined 170.6 BTC Holdings3 165.8 BTC $14.4 million BTC per Share4 $2.81 FY24 Revenue2 $11 million FY24 Core EBITDA $3.9M April 2024 Halving Revenue

Q4’24 and YTD’25 Operational Highlights 2024 Mined 170.6 BTC for FY’24 Acquired 15 MW Mining Facility in Oklahoma in Q4’24 2025 Achieved 0.6 EH/s with Oklahoma site LuxOS firmware upgrade estimated to enhance efficiency 10-15%; increasing revenue and profits without additional capex Mined total 16.1 BTC through the two months ended February 28, 2025

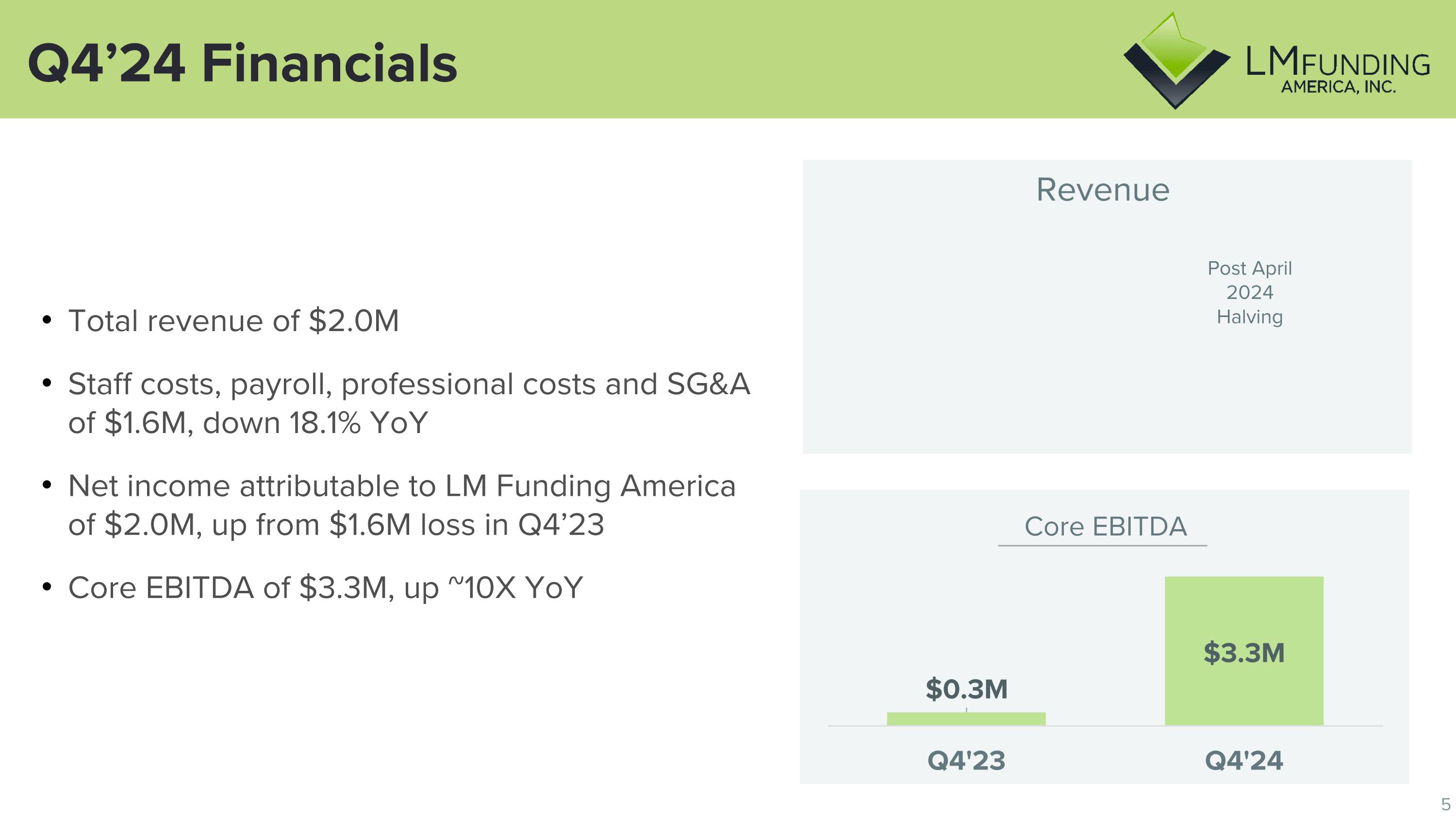

Q4’24 Financials Total revenue of $2.0M Staff costs, payroll, professional costs and SG&A of $1.6M, down 18.1% YoY Net income attributable to LM Funding America of $2.0M, up from $1.6M loss in Q4’23 Core EBITDA of $3.3M, up ~10X YoY Post April 2024 Halving

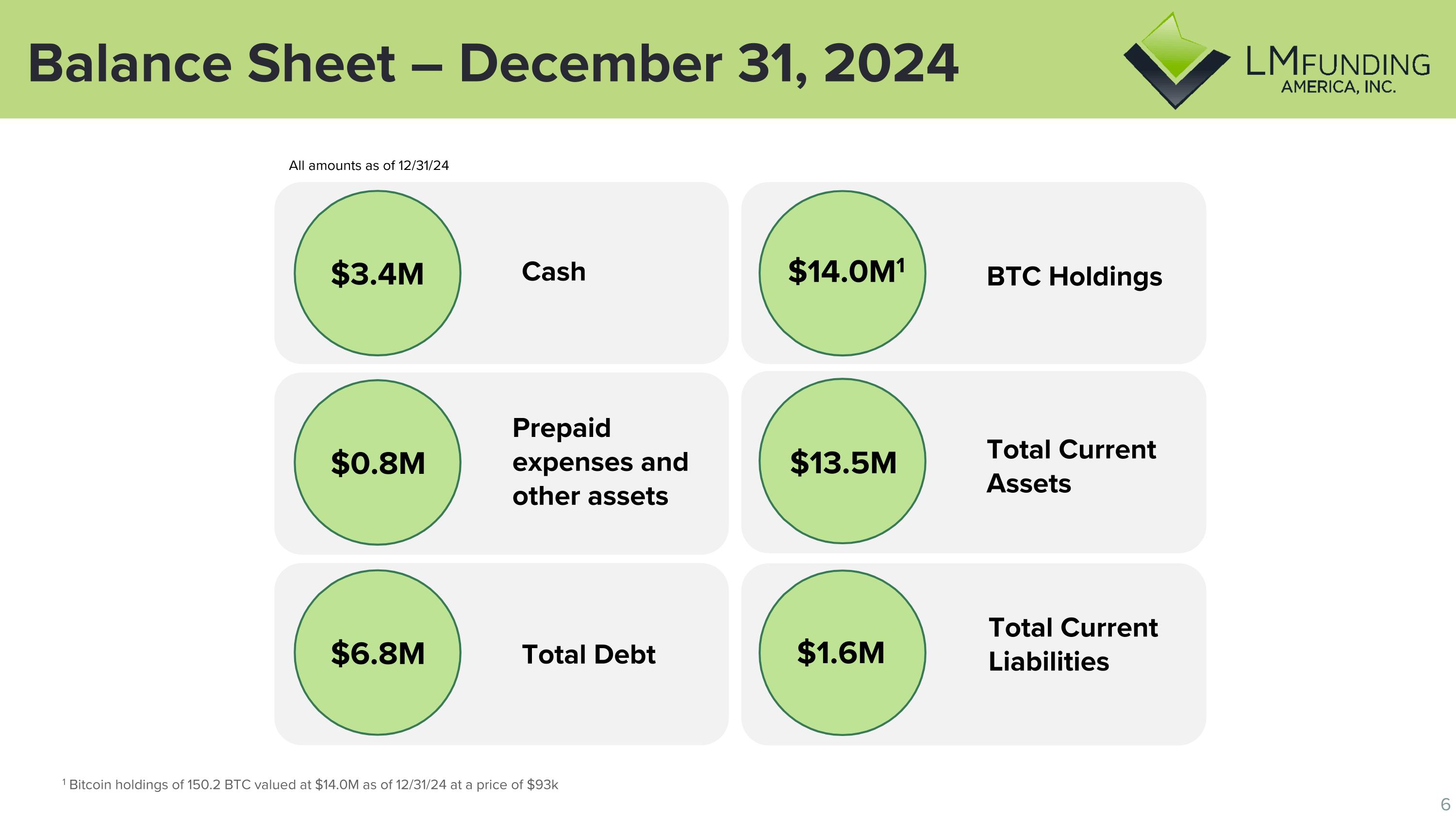

Balance Sheet – December 31, 2024 Cash Prepaid expenses and other assets Total Debt BTC Holdings Total Current Assets Total Current Liabilities $3.4M $0.8M $6.8M $14.0M1 $13.5M $1.6M All amounts as of 12/31/24 1 Bitcoin holdings of 150.2 BTC valued at $14.0M as of 12/31/24 at a price of $93k

Differentiated Strategy Vertically integrated Targeting 5 – 20 MW facilities Disciplined Opex Strong balance sheet + HODL Strategy BTC backed debt BTC Holdings = $14.4M1 1 Bitcoin holdings of 165.8 BTC valued at $14.4M as of 3/26/25 at a price of $87k

An emerging leader in Bitcoin mining & specialty finance LMFundingIR@orangegroupadvisors.com Q&A

An emerging leader in Bitcoin mining & specialty finance LMFundingIR@orangegroupadvisors.com Financials

Balance Sheet

Income Statement

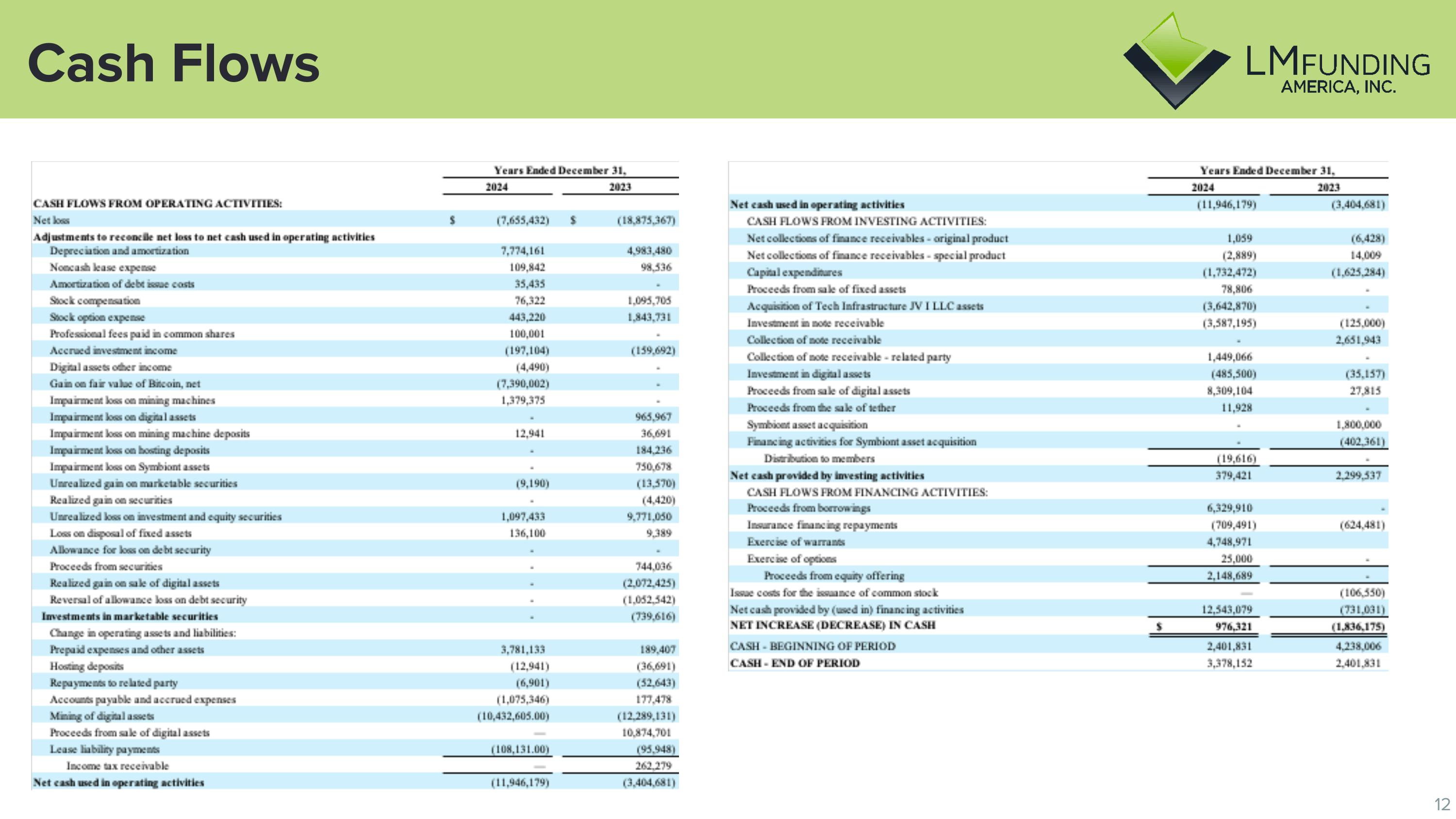

Cash Flows

Core EBITDA (Non-GAAP) Non-GAAP Financial Measures Our reported results are presented in accordance with U.S. generally accepted accounting principles (“GAAP”). We also disclose Earnings before Interest, Tax, Depreciation and Amortization ("EBITDA") and Core Earnings before Interest, Tax, Depreciation and Amortization ("Core EBITDA") which adjusts for unrealized loss on investment and equity securities, unrealized gain on convertible debt securities, gain on adjustment of note receivable allowance, impairment loss on mined digital assets, impairment of intangible long-lived assets, impairment of prepaid hosting deposits, impairment of prepaid mining machine deposits and gain on adjustment of note receivable allowance, non-cash lease expenses, costs associated with At-the-Market Equity program, contract termination costs, Impairment loss on Symbiont assets, impairment loss on mining equipment, and stock compensation expense and option expense, all of which are non-GAAP financial measures. We believe these non-GAAP financial measures are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of Bitcoin miners. The following tables reconcile net loss, which we believe is the most comparable GAAP measure, to EBITDA and Core EBITDA:

An emerging leader in Bitcoin mining & specialty finance LMFundingIR@orangegroupadvisors.com Thank You